The Story:

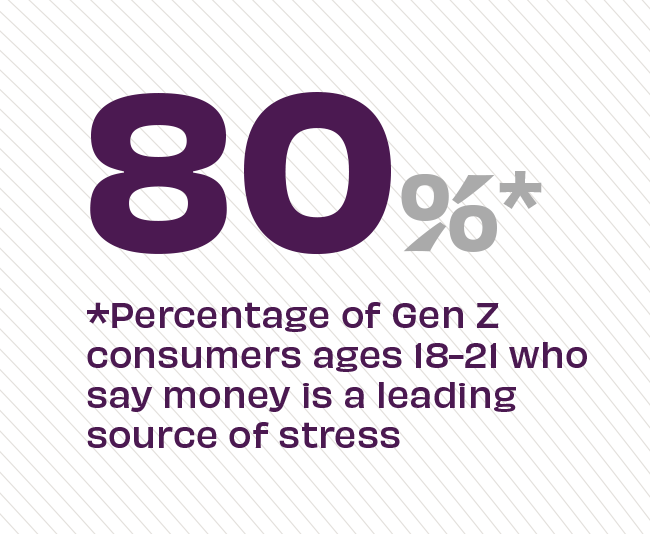

For a group of people who grew up in the shadow of The Great Recession and endured the Pandemic Recession, Gen Z consumers are no strangers to tumultuous economic times. So, it comes as no surprise that four out of five 18-21 year-olds report that money is a significant stressor in their lives. But for a generation with purchasing power reaching $360 billion, Gen Z is already having a significant influence on the kinds of financial products and services banks and credit unions offer them to empower their financial lives.

The Takeaway:

As they make their first decisions about money – like establishing and using credit wisely and beginning their primary banking relationships – members of Gen Z seek knowledgeable, credible sources of support. While Gen Z consumers report they’re reticent to take on debt, they need more guidance. “Providing financial literacy tools will benefit both Gen Z and credit unions resulting in long-lasting, engaged relationships, according to “Gen Z: The Fast And Furiously Cashless” report. “The education tools should be available to Gen Z via digital channels, such as on a website, within a credit union’s mobile app, or via virtual classes,” to meet Gen Z consumers where they are.

Source: Elan Financial Services Report in Creditunions.com, “Gen Z: The Fast And Furiously Cashless,” 2020