After a COVID slowdown in financial services M&A during most of 2020, the banking sector is on the precipice of a new wave and a new form of activity in 2021

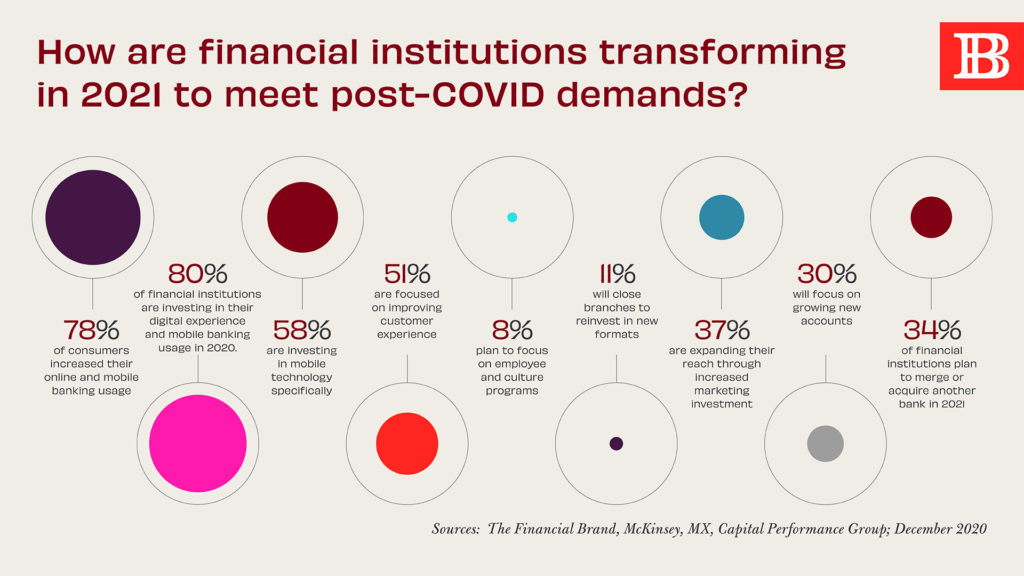

The impact of COVID on all areas of banking operations in the last year is apparent everywhere you look. Certainly, the most noticeable is pressure – other than safely serving customers, in lobbies or remotely – to deliver better banking experiences in response to COVID demands – laddering digital and physical channels toward an ideal omnichannel state.

Less obvious to the consumer – but no less critical to banking’s future – is the impact of COVID on strategic business decisions, especially those around mergers and acquisitions. A downturn in deals throughout 2020 meant that many banks paused efforts for growth, a position that can only be sustained for so long. Now, the challenges and changes wrought by the pandemic have a flip side: new opportunities for growth.

Snapshot 2020

Prior to the pandemic, most banking M&A deals were about expanding geographic influence, spotlighting the branch network as the primary driver for growth. Understandably, deals hit the brakes as the impact of the pandemic became clearer and banks necessarily shifted their resources and operational focus toward a COVID banking response. Further, bank valuations took a big hit during the pandemic, leaving many banks that may have previously wanted to merge waiting for their assessed value to go back up before even considering inking a deal.

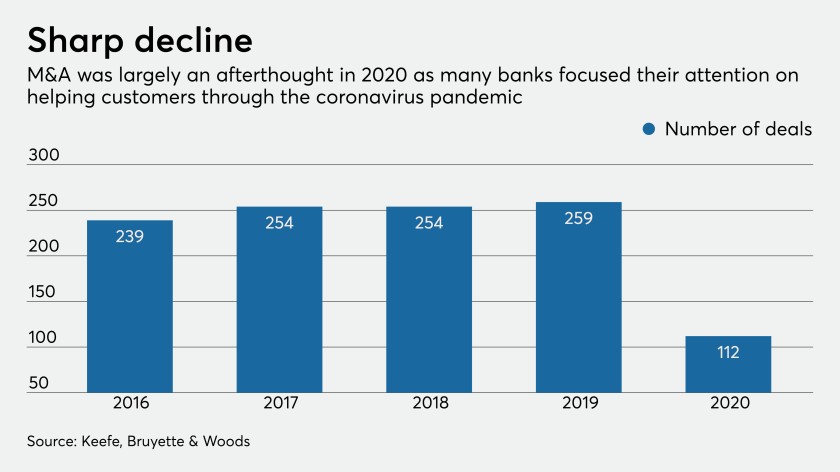

The M&A slowdown, while not unexpected, did have an immense impact on banking’s financial outlook for the year. According to American Banker: “Only 112 bank mergers were announced in 2020, down 60% from a year earlier and the lowest annual tally in nearly a decade… Several of those that were announced were ultimately terminated after the pandemic hit.” But even as early as late summer, prospects were looking up with mergers and acquisition activity beginning to pick up steam and S&P Global reporting that banks were feeling more “confident and optimistic.”

Forecast 2021

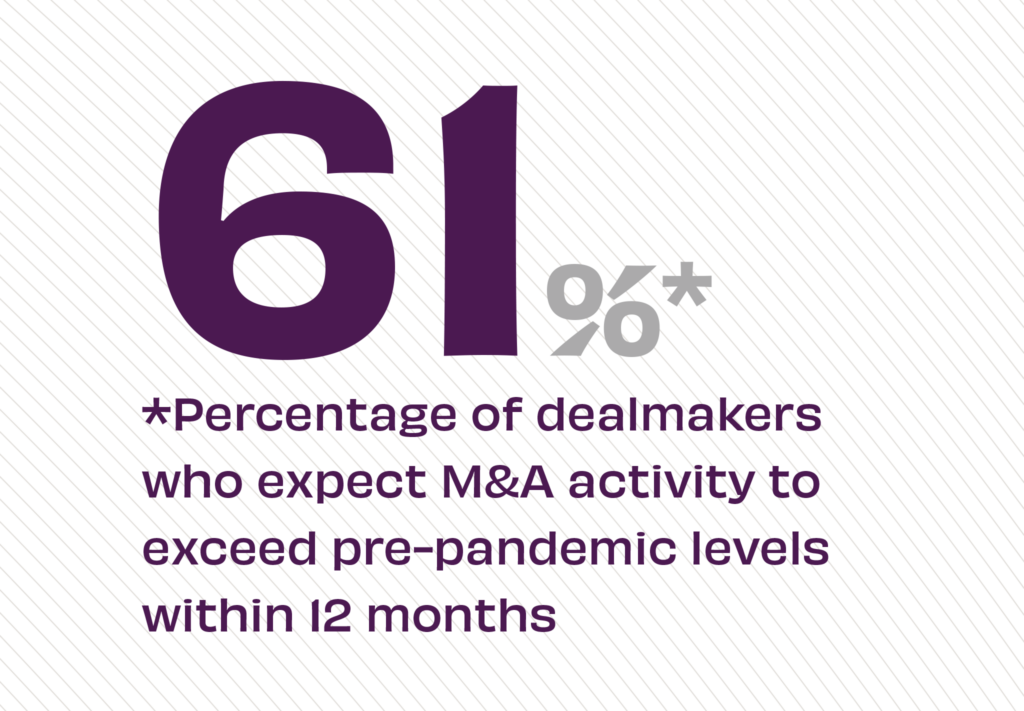

Economywide, analysts are expecting to see a surge in M&A in 2021, with deals less typical in scale and scope than more straightforward mergers-of- equals or bigger companies swallowing up smaller ones. As general merger interest ticks upward, a new survey of middle-market companies and private equity firms predicts more robust deal-making, especially in the second half of the year. Jim Childs, CEO of Citizens M&A Advisory, says “a backlog of pent-up demand” for mergers and acquisitions coupled with “strong valuations” will mean an eagerness to make more deals.

As bankers scrutinize the valuation landscape for their sector, some key drivers for previous M&A surges are also at play now. American Banker finds that “low interest rates, a need to cut costs and the need to invest in technology” were present before the pandemic, but “the pandemic may have made those pressures more acute.” According to Sean Keathley, president and CEO of Adrenaline: “At this point, it’s valuations that are holding up banking M&A deals. The dam is just waiting to burst. The desire is certainly there, but banks don’t want to sell too low.”

Different Kind of Deal

In Competing Pressures, Robert Klingler who specializes in M&A banking deals says, “Banks are sold, not bought, and the many reasons a bank might sell all appear to still be present in 2021.” But while the pressure to sell may be building, making strategic investments is critical. As we outlined in Digital + Physical Delivery, “Consumers expect digital and physical to seamlessly integrate into holistic banking experiences, not be defined by rigid, bank-defined boundaries between branch and mobile.” So, while banks may merge to primarily enhance the branch network, they can’t do it at the cost to in-demand digital.

An interesting development for mergers and acquisitions across the board is a rethinking of what makes a worthy M&A deal. Deloitte’s M&A Trends finds that the reshaping of economies in a post-COVID world will result in deals that look very different. Mark Purowitz, principal of Deloitte’s Mergers and Acquisitions Consulting Practice, says, “Companies were starting to expand their definition of M&A to include partnerships, alliances, joint ventures, and other alternative investments that create intrinsic and long-lasting value, but COVID-19 has accelerated dealmakers’ needs to create more optionality for their organizations…”

The Takeaway

What does reconceptualizing or reshuffling the M&A deal mean for banking specifically? We think it will mean more deals driven by partnerships and strategic alliances that solve for particular pain-points or the need to fill gaps in CX – not just those acquisitions focused on physical presence and the branch network. The deals between larger FI categories can also give us some insights into what’s to come. In 2020’s largest financial services merger, for example, Morgan Stanley purchased online brokerage E*TRADE Financial and fund manager Eaton Vance, solving for two operational fundamentals for the investment bank: digital transactions and consultation.

We also expect to see a number of deals between fintech and traditional banks, whether payments or the mobile space. The pressure to beef up remote offerings during the COVID-19 crisis is well documented, and for community banks and credit unions, meeting consumer demands for digital channels for transactions is an ongoing priority. According to S&P Global’s Market Intelligence: “Buying up small, innovative fintechs can be a faster and more effective way for banks to improve their tech offerings, and the infrastructure that supports them, than building their own solutions.”

In upcoming episodes of the Believe in Banking Podcast, hosts Sean and Gina will talk with industry leaders in both M&A and digital disruption. For more insights on M&A and the impact on community banks and credit unions, stay tuned to Believe in Banking as it tracks the big trends, both inside and outside the industry, that are impacting financial services and informing the banking experience. To develop experience-based strategies for customers and members, especially in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.