How branch networks help financial institutions meet consumers where they are and make the most of all-time high acquisition opportunity

As communities across the U.S. commence the early phases of a post-pandemic summer, retail and restaurants are ready to welcome people back in full force. Bank branches – most of which have been largely operational for months – are also ready for a robust return to normal. But some of their networks may look different post-pandemic because of some permanent branch closures during 2020, according to S&P Global Market Intelligence. While these branches may have already been in the bubble, COVID sealed their fate, as banks prized efficiency and cost-cutting measures during an uncertain time.

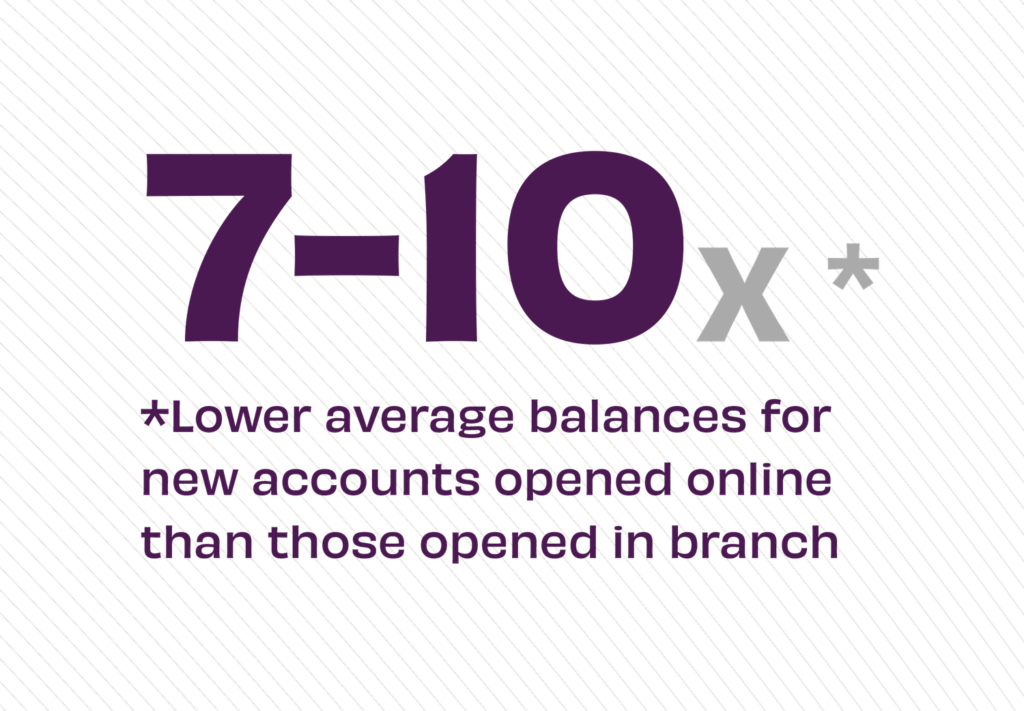

For those still assessing their networks in 2021, driving cost out is only half of the consideration. “As banks consider network strategy plans, there is a strong bias toward realizing near-term cost savings,” according to Novantas in their look at retail banking in 2021. “The major caution is that consolidations result in lost sales for the bank and most institutions haven’t found ways to drive increased sales outside of the branch network.” That same Novantas analysis finds the branch network is consumers’ most cited factor for new financial institution consideration. The reality is that consumers open more accounts in person at the branch, have lower account attrition, and those accounts are worth more than those opened digitally.

Investing in the Branch

That’s why Chase bucked closure trends and doubled down on their branch network in 2018 with a commitment to invest more than $20B in 400 branches, continuing apace even in the midst of the pandemic. Already halfway to their goal in 2021, the banking leader is “closing in on being the first U.S. bank to have a brick and mortar presence in every state except Alaska and Hawaii,” according to Reuters in 200 Down, 200 To Go from June 2021. And that investment is paying off, with deposits more than tripling from 2019-2020 according to the FDIC’s 2021 market share report. So important is an effective branching strategy that other FIs – community-sized and big banks alike – taking notice, with some of their own notable expansions.

Marketplace reported on Citibank’s branch expansion citing the opportunity to cross-sell as a key driver of value for banking, and noting that as a consumer’s relationship with their primary FI matures, their banking needs shift from transaction-based activities to more consultative engagements. Further, if you’re a big bank like Citibank or Chase, the branch network is additive to the Halo Effect of your brand. “You know, being the top of mind, as the biggest brand, that’s got to be an advantage in thinking about where to invest dollars,” according to Barbara Kahn, a marketing professor at the University of Pennsylvania’s Wharton School of Business.

Consumer Preference

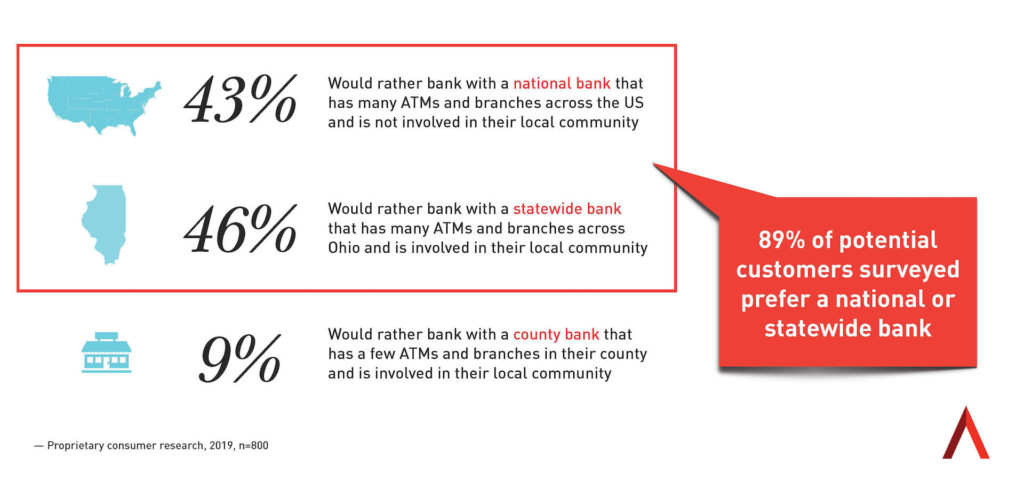

While it’s understood that the branch represents an essential revenue stream for banks, more importantly, is its critical connection point for consumers. Even if routine banking is available via other channels, for those who prefer to bank in person, a shrinking branch network has unexpected and sometimes undesirable consequences, as the Guardian explores in its article on the cost of shrinking branch networks on aging customers. Adrenaline’s proprietary research finds that nearly 9 of 10 consumers want a financial institution that is at least “statewide” in size. That’s because network size connotes available resources to consumers, meaning a bank is big enough to meet their needs.

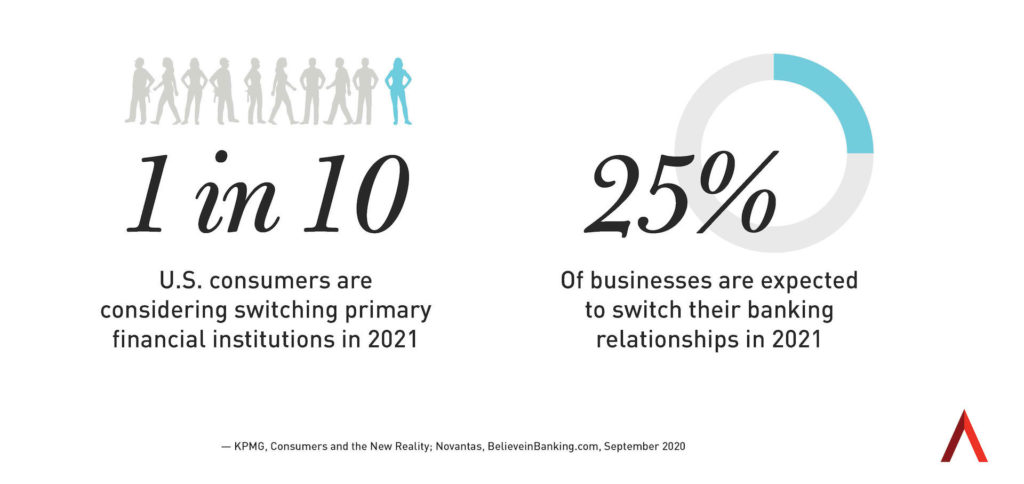

While the perceived scale is critical for consumers, the opportunity is also at an all-time high. According to Banking Exchange, “Though 85% of Americans say they will continue to use digital tools to the bank after the pandemic, 62% of banking customers still prefer physical branches.” What happens in those walk-in branch visits is fewer transactions, but more new-to-bank sales. Further, the pandemic is revving up post-pandemic switching activity as people look to streamline their financial lives. Consumers do that by consolidating accounts with a single provider who can serve all their needs.

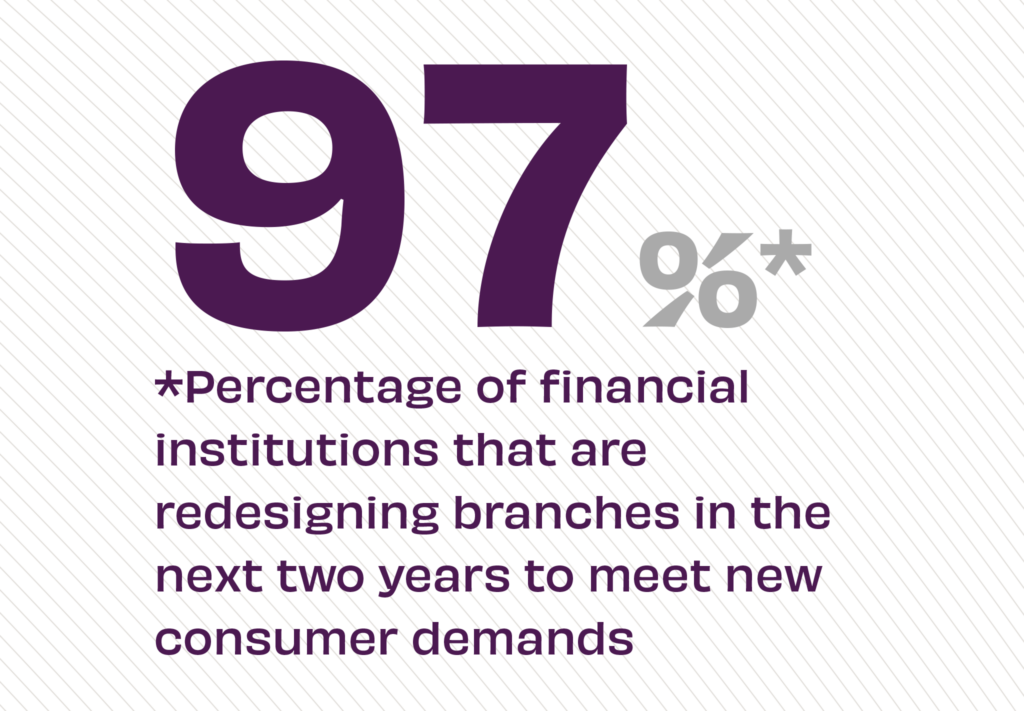

Banks understand that the branch represents a balance of efficiency and experience to maximize their prospects. That’s why 97% of FIs plan on redesigning branches over the next two years. Banks and credit unions have the opportunity to reimagine the branch experience for consumers, including both the strategic composition of their networks and their branch formats while driving CX that connects with consumers. “Maintaining a bold street presence remains critical in competitive retail banking markets,” according to Financial Brand’s exploration about why branches still matter. “As the population of branches shrinks, visibility will grow even more critical.”

Stay tuned to Believe in Banking as we track the big trends that are impacting financial services, like how to activate data intelligence to inform decision-making across all channels, from the brand to the branch. Be sure to also see Adrenaline’s insights about branch conversions following M&A in the Financial Brand’s recent article Avoiding Branch Rebranding Headaches in Mergers and Acquisitions. To develop experience-based strategies that leverage the power of the branch, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.