The Story:

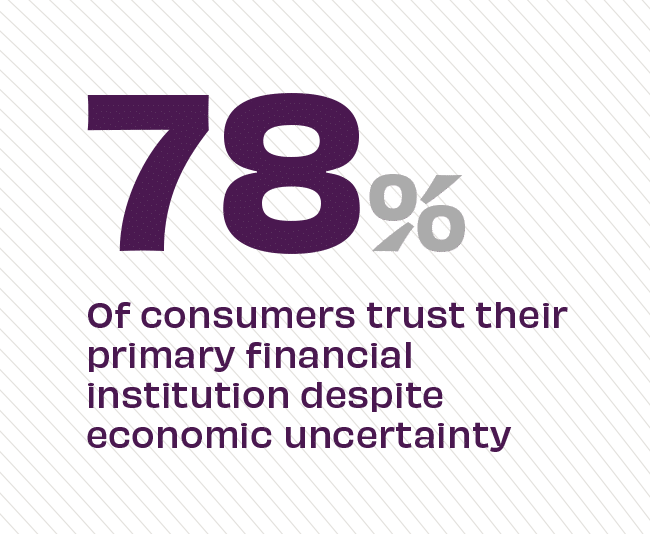

Nearly eight out of ten consumers say they trust their bank or credit union, despite uncertain economic conditions and banking sector challenges during the last year. The U.S. Banking Disruption Index surveyed more than 2,000 U.S. consumers who conveyed confidence in their banking relationships, even if they weren’t always completely satisfied with their bank’s approach to innovation and digital offerings. Not only did consumers say they believe in their bank, the rate of trust people have in their primary financial institution rose 28% year over year in 2023 compared with the previous year.

The Takeaway:

While people report high levels of trust in their primary financial relationships, these numbers should not result in banks and credit unions resting on their laurels. Instead, financial institutions should leverage this inherent trust into deepening relationships with their customers by providing products and services that are matched to their life stage and financial needs. At the same time, banks can also take the opportunity to expand their digital offerings – something the survey finds is a potential a source of weakness for incumbent banks – which will both increase current customer satisfaction and broaden institutional appeal to Gen Z consumers who are just starting their banking relationships.

Sources: GFT, “The U.S. Banking Disruption Index,” September, 2023; Fintech, “U.S. Banks: Do American Consumers Still Trust Them?” August, 2023; Forbes, “Trust in Traditional Banks Remains High,” August, 2023; and Banking Dive, “Trust in Banks Remains Steady, While Fintechs Have Ground to Cover,” November, 2023