The Story:

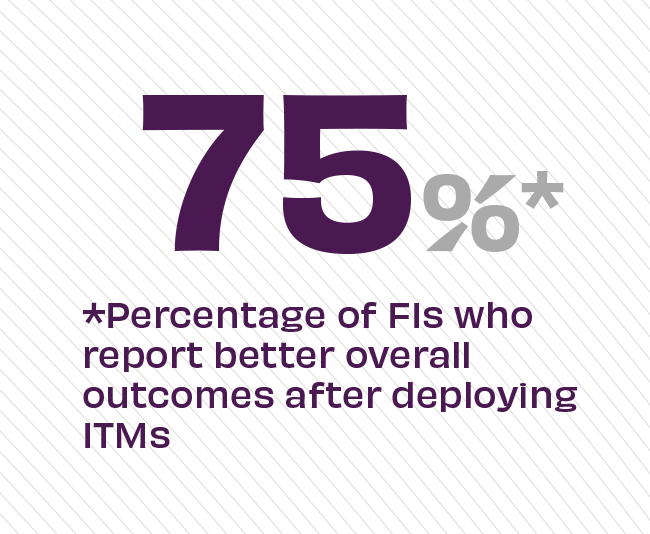

Institutions that deploy Interactive Teller Machines (ITMs) see sweeping improvements in efficiency, despite their upfront costs, according to industry-leading data on ITMs. Realizing immediate savings, ITMs help turbocharge staff efficiency and reduce both cost-per-transaction and FTE costs for their institutions. Even more, FIs can further reduce costs by shrinking bank branch footprints and using ITMs as dot-connectors between larger bank formats. But it’s not just banks who benefit. Customers are embracing the technology, with 52% of current ITM users stating that they are extremely or very satisfied with their experience.

The Takeaway:

ITMs can help FIs reimagine their presence in their communities. With ITMs providing convenience and human connection, bankers in the branches can focus on more fruitful customer experiences that lead to greater brand loyalty. According to a credit union CEO: “Our staff loves the ITMs because they can focus on bigger value sales. There are fewer people coming into the branch, so we need to make those individual visits count. The technology actually has the effect of elevating our people.”

Sources: Adrenaline, “ITMs: Bridging the Digital and Physical Worlds,” June, 2022