The Story:

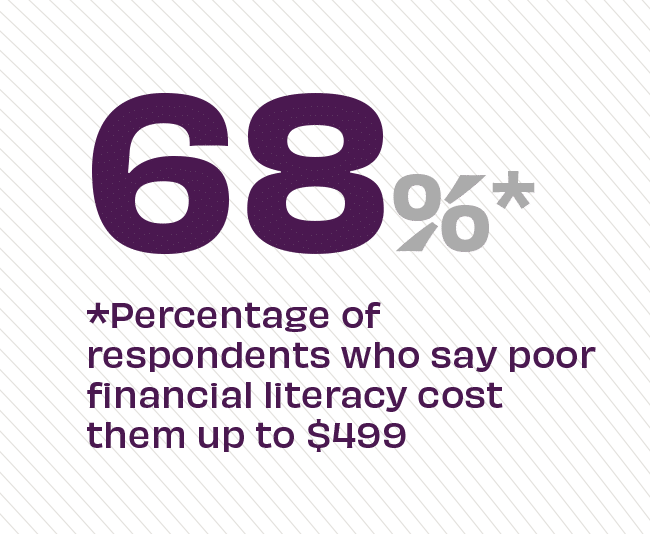

Data from the National Financial Educators Council finds that nearly 7 out of 10 consumers report losing up to $499 because of low financial literacy, with 15% reporting it cost them an eye-popping $10,000, up from 11% in 2021. With such a high cost to low financial literacy, the need for consumer education around financial issues is clear. But how do we start? According to experts, the prime time to teach people about financial literacy is before reaching adulthood, when many crucial financial decisions are made, like buying your first car, taking out college loans, opening a credit card account, etc.

The Takeaway:

Although only 24 states require financial literacy coursework ahead of high school graduation, banks and credit unions can (and should) partner with schools to provide financial literacy programs for students. Additionally, banks should offer financial literacy education and tools to their customers and members, including things like information modules, loan calculators or in-person advice about budgeting and planning. In an effort to reach Gen Z consumers, many credit unions have been gamifying their educational offerings through apps and online resources, to help young people get in on financial literacy early.

Source: CNBC, “Lack of Financial Literacy Cost 15% of Adults at Least $10,000,” January, 2023