The Story:

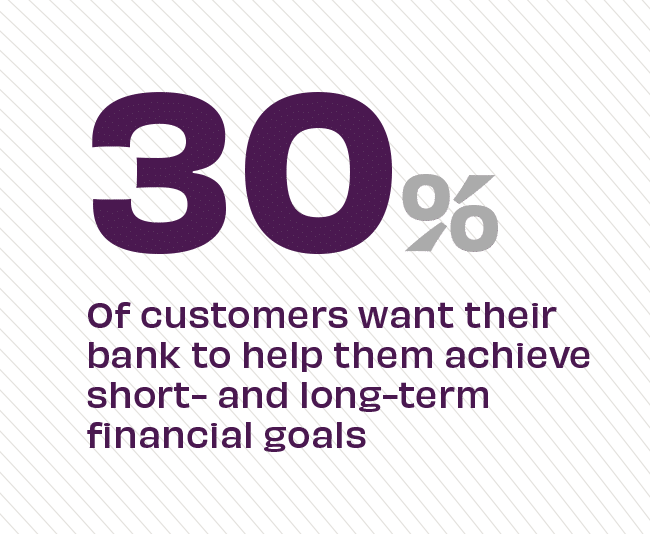

In our challenging economy, consumers understandably expect a lot from their primary banking relationship. They want fast transactions at the point of need and expert advice for moments that matter. While data shows that all consumers want financial support from their banks, younger generations say they need it even more – as they enter the workforce and seek out solutions for saving and spending wisely. What that means for financial institutions is that they must make consumer financial well-being a core part of their business strategy and a key way to expand on their opportunities.

The Takeaway:

The way banks create meaningful engagement that’s at the heart of enduring relationships is to customize and humanize financial support. Generic advice on a blog post that they have to seek out simply won’t do. “You have to find ways to give them hope,” says Manthei, a business development specialist for GreenPath, interviewed in the Financial Brand. “You have to dig into your data and identify how you can serve each person and create touchpoints that connect those pieces of content to the right time in their journey.”

Source: Ernst & Young, “NextWave of Consumer Financial Services,” August, 2023