The Story:

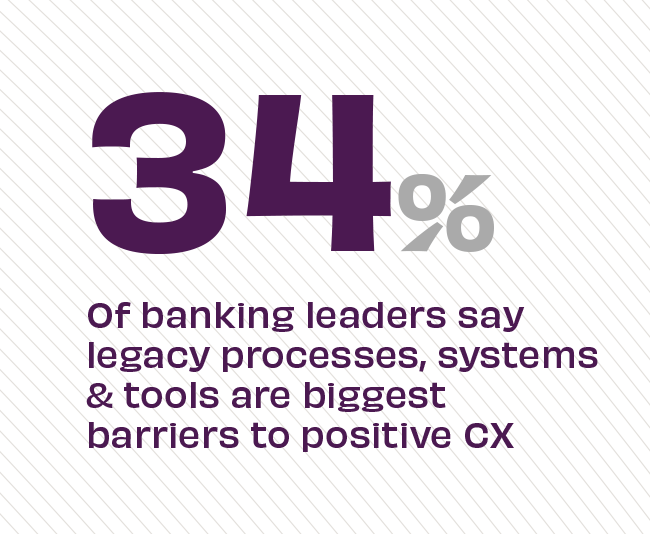

While financial institutions have excelled in creating seamless in-person and digital customer experiences, internal operational processes remain a cumbersome reality for some banks, with employees encountering challenges as they navigate multiple systems to process even straightforward account openings. In an age where 71% of customers seek conversational experiences and 70% expect banking staff to understand the full context of their individual needs, disjointed systems create unnecessary hurdles for employees as they seek to deliver valuable customer consultations. “An often overlooked opportunity to improve the employee experience is to understand the employee journey the same way we visualize the customer journey,” according to BAI. “This means mapping every step of the end-to-end employee experience.”

The Takeaway:

Once more optimal front-end systems are in place, banks and credit unions can focus on harmonizing their back-end operations and crafting actionable employee journey maps. “The actions employees take, or don’t take, create your customers’ experience, and determine how they feel about interacting with your brand,” according to the Financial Brand. Using internal data and activating engaged employees will lead to better customer journeys. “Harnessing [employee] data and analyzing it alongside customer experience data, banking institutions can start to identify which behaviors lead to the best CX.”

Sources: BAI, “The Overlooked Employee Experience Opportunity,” August 2023, Zendesk, “CX Trends 2023,” May 2023, and The Financial Brand, “How Engaged Employees Improve Banking’s Customer Experience,” October 2022