Credit unions redefine their identity and reclaim their future

Change is never easy. Change in a time of upheaval can feel impossible. For financial institutions navigating the new normal, change may be necessary for survival. However difficult change may be, credit unions, in particular, have a unique post-COVID opportunity given their purpose-driven approach, their deep community roots, and their commitment to ‘people helping people’.Credit Union growth was already slowing in 2019, and the pandemic only strengthened the trend in 2020 with membership increasing by only 2.7% this year compared to 3.9% in April 2019 and 4.2% in April 2018. While every industry is measuring their response in the wake of a global pandemic, there are generally two schools of thought for institutions facing a large-scale challenge: preserve what you have or prepare for the future. Given that prospects are contracting post-COVID, preservation isn’t so cut-and-dried.

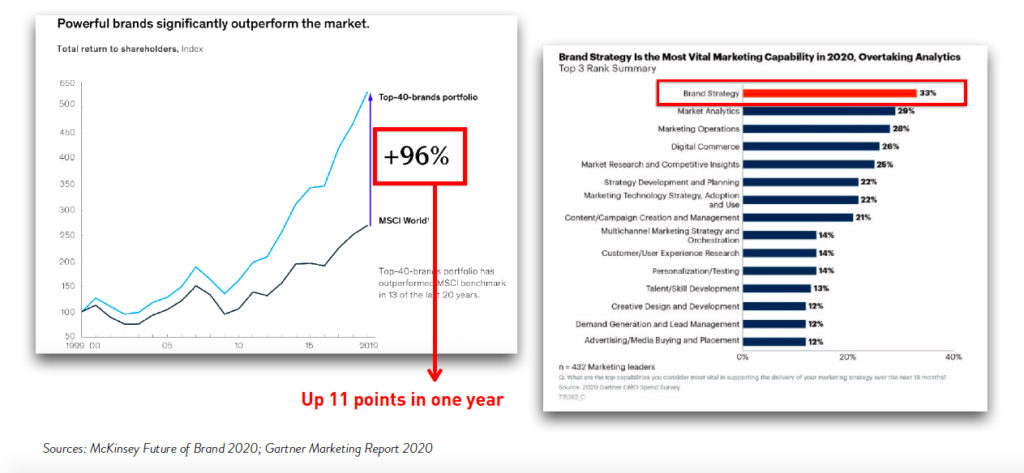

As fewer people are considering a change to their financial relationships during the pandemic, brand becomes the defining factor for credit union relevance now and in the future. Today, a strong brand isn’t just a nice-to-have: A renewed focus on brand values results in strong brands outperforming the market by 96%, up 11 points in one year. Further, brand actions during these challenging times and a focus on brands living their purpose present some of the most powerful instances of resilience in our current era. While it may be difficult to imagine, it’s necessary for all financial brands, especially credit unions, to look beyond the crisis.

Defining CU Brand Purpose

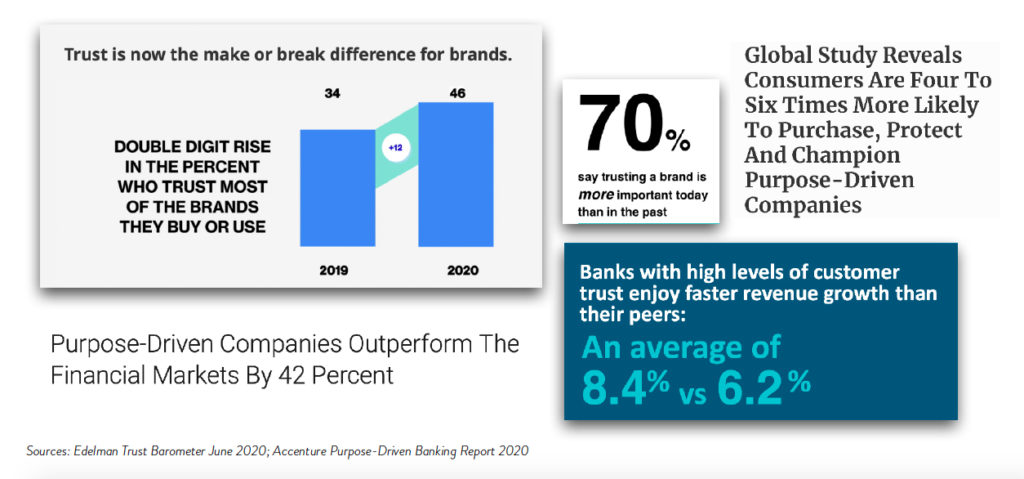

In the special June 2020 edition of the Edelman Trust Barometer, it’s plain to see that brands that clearly convey their purpose and engender trust in their consumer relationships are outperforming those that do not. Leaning into your purpose as a brand is one of the most powerful ways of building future prospects. According to McKinsey, “In times of rapid change, strong brands particularly need the benefits of these robust foundations: a deep understanding of customers and the market based on rigorously tested concepts, a clear purpose brought to life by creativity, and an inspiring brand experience delivered consistently across all touchpoints to drive both brand perception and business performance.”

As ‘people helping people’ serving their members’ financial interests, credit union brands are naturally anchored by a strong purpose—and as such, enjoy a high level of trust. While providing competitive products and services is at the heart of what successful CUs do, their not-for-profit, cooperative status gives them a level of legitimacy unmatched by other financial institutions. Though they may understand that developing a cohesive brand strategy is central to success, many credit union brands are chained to legacy names that no longer represent their current positioning or presence. No matter how much a credit union may love their roots, marketing efforts cannot overcome a name deficit.

What’s in a Name? Opening the Doors to Entry

Research routinely shows that one of the biggest barriers to entry—and therefore growth— for credit unions is a name that communicates a very narrow field of membership. As charters expand, new names represent an opportunity to reframe perceptions around who can join. Though change is tough, Adrenaline’s research indicates that in a vast majority of circumstances, a credit union name change won’t adversely affect the current member base. Instead, what it will do is attract new members with a more modern presence and a fresh persona. Further, the best opportunity for account growth is new relationships with younger generations, Millennials and Gen Z, who typically respond positively to new names, with little attachment to and understanding of legacy naming practices.

While examples of brand name and identity changes in the consumer space are not hard to find, as brands change their names to move away from a problematic past, those specific to financial brands—and especially those in the credit union space—are not easily discovered. With 5,200+ credit unions and more than 120 million credit union members across the U.S., understanding the impact of name changes and rebrands on growth and financial performance is mission-critical. As Forbes identifies the best credit unions in each state, no small percentage of these member favorites have shed their legacy identities. But what are the proof points that credit union renames work?

Expanding Prospects and Driving Growth

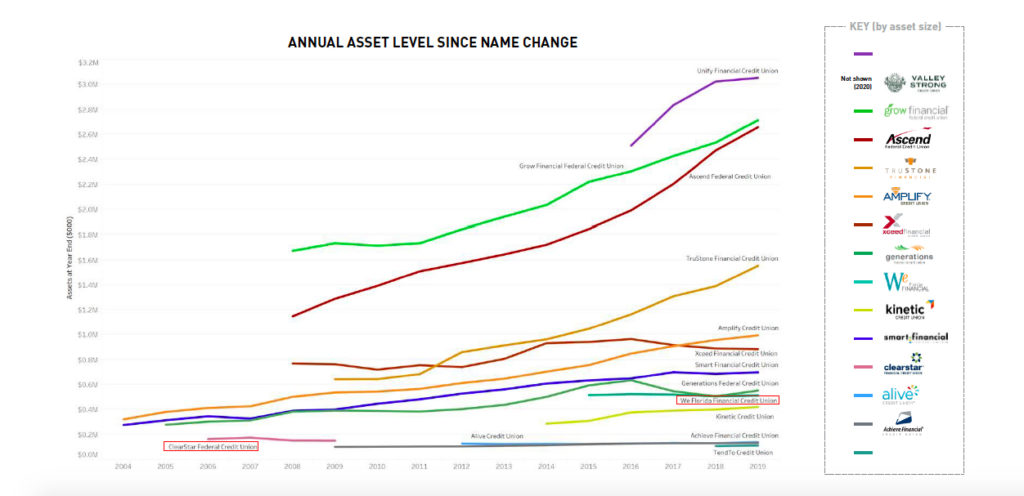

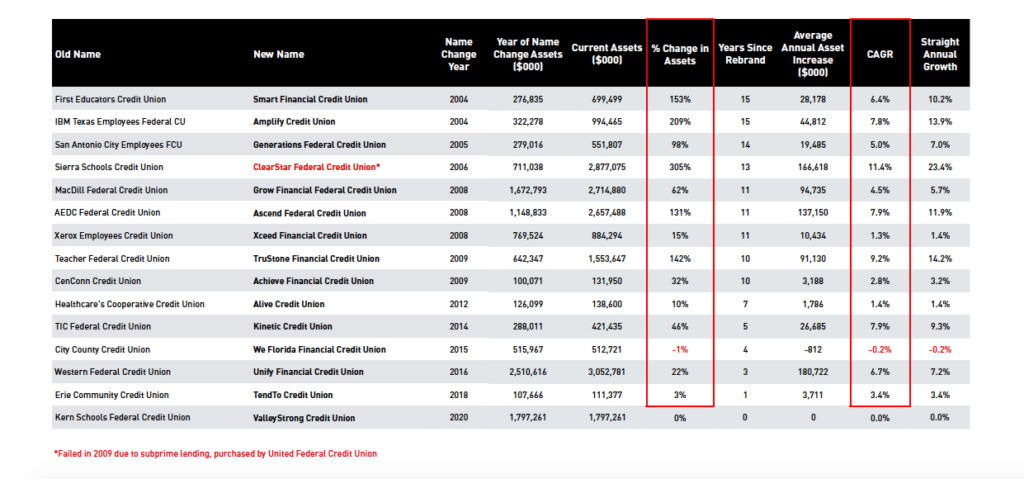

Over the past 15 years, Adrenaline has consulted on 15 credit union brand renames, positioning these financial institutions to take advantage of their fair share of prospects in their current and growing service areas. Before rebranding, a full 13 of those financial institutions found limited growth stemming from their legacy and select employer group (SEG) monikers that no longer represented their wider target audience or member demographics. Since their name change, 87% of these credit unions—or 13 out of 15—have seen their assets grow significantly.

Not only have these community financial institutions grown, their compound annual growth rate (CAGR) has achieved an average of 5.4%, outperforming the credit union average over the years that follow their new names. Those with higher assets achieved an even greater rate of growth, with six of these CUs realizing a percentage change in assets at a rate of 98% or higher, demonstrating that their rebranding/renaming campaigns have subsequently positioned them to deepen their member base in existing markets and expand their reach into new markets. In other words, the rebrands helped supercharge their growth potential.

Key Considerations for Renaming

For credit unions evaluating this opportunity to futureproof their brands with a new name and identity, here are five key questions to ask that will help begin the process:

- Does your credit union name inherently communicate exclusivity over who can join?

- Does your credit union reflect the aspirations of your current or future membership?

- Does your credit union name present a promise or value you can deliver on?

- Does your credit union name appeal to a new generation of financial consumers?

- Does your credit union name look more toward the future or to its past legacy for meaning?

While the rebranding process may seem like a daunting prospect right now, brands that view history through the lens of opportunity realized both immediate impact and long-term success. And the COVID-driven pause on some enterprise activities has created both the time and space to reinvest in brand infrastructure. Now may be your golden opportunity to not only survive the COVID crisis but to thrive with a credit union brand that speaks to consumers’ needs today and sets a successful course for continued future growth.

To develop strategies for rebranding and renaming in the post-COVID landscape, contact Adrenaline’s financial and brand experts at info@adrenalinex.com or call (678) 412-6903.