Investments made by banks of all sizes result in a better economic outlook thanks to the efficiency and experience technology drives

New reporting shows that investing in technology may have a short-term impact on financial institutions’ bottom line, as consumer expectations for digital continue to drive the demand for innovation in banking. According to the Financial Times, two of the biggest banks – Bank of America and JPMorgan Chase – expect rising costs to constrain otherwise blockbuster Q3 results. But in the wake of healthy interest and fee income and rebounding consumer confidence as the current COVID wave wanes, the efficiency will help deliver long-term benefits for the banking industry.

For community banking, the proof is already in the pudding. At the end of September, the FDIC reported that community-based financial institutions that invested more in technology before the pandemic ended up ramping up lending and raking in more deposits over the last year and half than did those with more meager earmarks for tech. According to ABA Banking Journal’s coverage of the report: “For many community banks and their customers, the pandemic was a crash course in the use of technology in all facets of banking,” the report’s authors wrote. While digital filled in a gap, it also accelerated consumer demand.

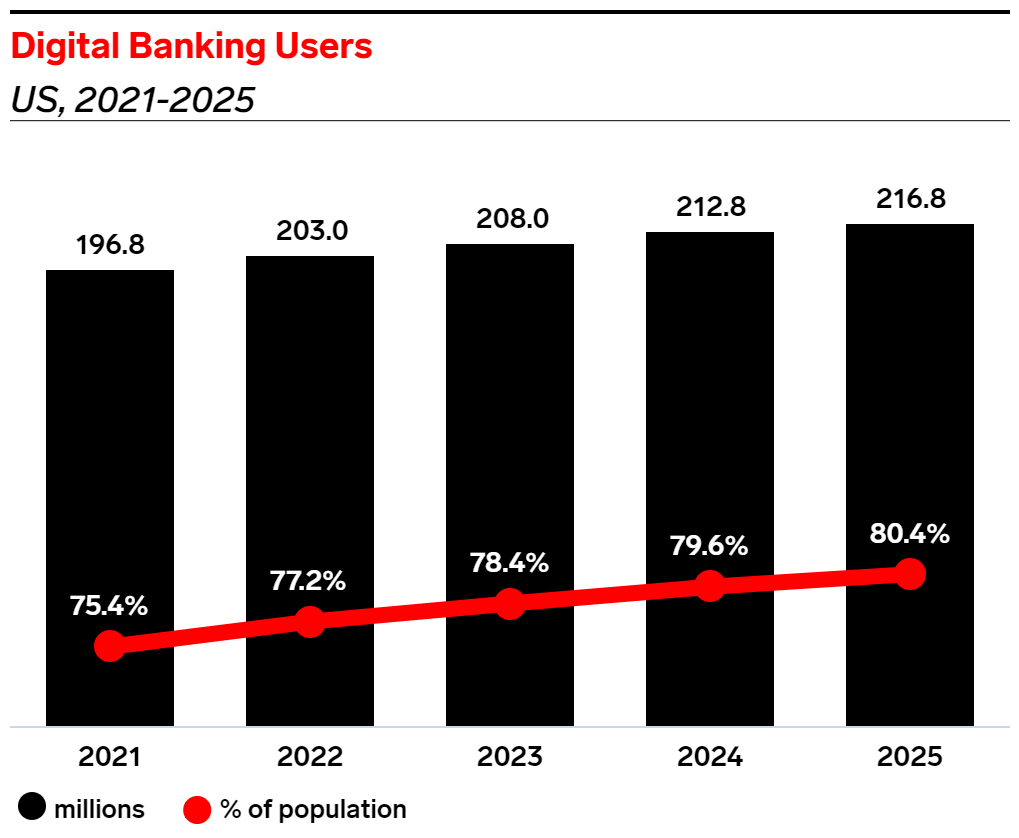

Source: Insider Intelligence, March 2021

According to Insider Intelligence: “Meanwhile, the overall proportion of US adult digital-banking users – those who use services at least monthly – is expected to increase from 75.4% in 2021 to 80.4% in 2025.” But while consumers see technology serving at least a proportion of their transactional needs, they still want a branch nearby when they need it, a fact reaffirmed by recent research finding that the “ability to visit a bank branch as the most important retail bank benefit,” according to Insider Intelligence. It’s that combination of digital and physical delivery that will simultaneously deliver more growth to banks and more value to consumers.