The Story:

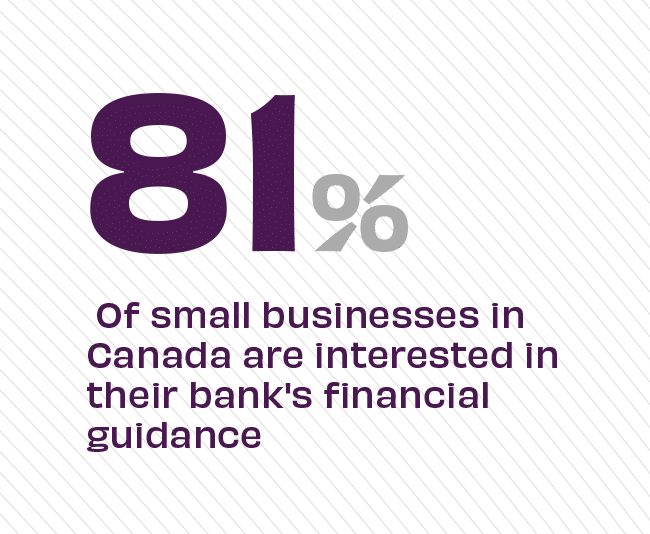

Data from J.D. Power finds that small businesses in Canada report a higher level of satisfaction with their banks than households do and are highly interested in their bank’s expertise to make their businesses stronger. However, only 56% indicate receiving financial advice or guidance from their bank in the past 12 months, and only 51% strongly agree that their bank provides useful advice or guidance. This is truly an opportunity for banks to deliver superior customer service and customized support for small businesses. Since 60% of small businesses consider themselves financially challenged – feeling strains of a weakening economy, inflation and rising interest rates – there is a pressing need for banks to offer council and advice now.

The Takeaway:

Despite the challenging environment for small businesses, a Scotiabank survey found that 66% of small businesses are very or extremely optimistic about the future of their business. This sense of optimism may come from the fact that these businesses have survived the pandemic when others did not. Regardless, since many financial institutions in Canada had opportunities to develop relationships with these businesses during the pandemic – facilitating loans as part of the CEBA program – they should continue to capitalize on these relationships by reaching out to offer further support, council and advice, especially now that loan forgiveness options will start becoming available in January 2024.

Source: JD Power, “J.D. Power 2022 Canada Small Business Banking Satisfaction Study,” October, 2022, ScotiaAdvice, “Resilient Small Business Owners,” August, 2023, and Government of Canada, “Canada Emergency Business Account,” October, 2023