The Story:

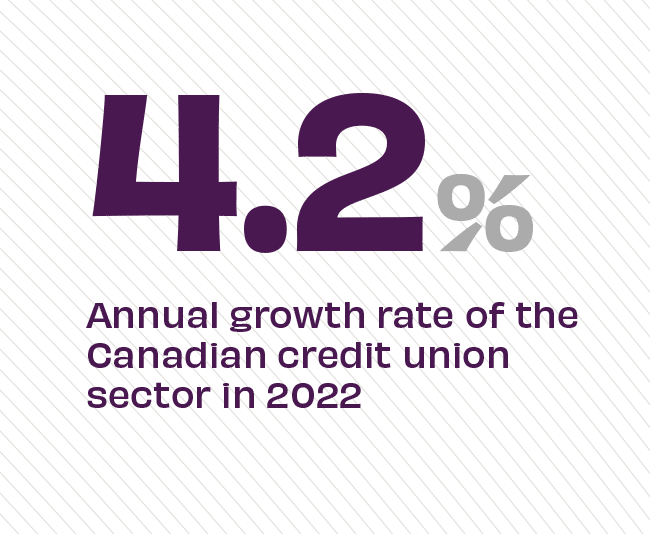

Canadian credit unions outperform rival financial institutions, delivering higher growth in 2022 than the sector’s year-over-year average since 2017. This strong performance is largely due to their ability to maximize opportunities to serve. Mortgage lending represents a growing area for credit unions, as big banks tighten lending requirements and stress testing for consumers in a rising rate environment. Even more, Canadian credit unions have more than tripled their market share of small businesses since 1982, with co-operatives currently holding 13% of the market today.

The Takeaway:

Credit unions in Canada rival the big banks, serving communities much the same way credit unions and community banks do in the U.S. Consumers and small businesses that are migrating away from banks to more locally-focused financial institutions are doing so for better customer service, access to financing and more competitive rates – all available right in their own neighborhoods. By distinguishing themselves as an alternative to the big banks, successful credit unions show their commitment to building relationships with members and demonstrate how the co-operative model is good for consumers and communities.

Source: IBISWorld, “Credit Unions in Canada through 2028,” July, 2022, and CFIB, “Financing Main Street: SME Market Share Among Major Banks,” July, 2023