Insights from the U.S. Banking Digital Trust Benchmark Report

New reporting on digital banking finds that COVID-19 spurred more institutions to advance their digital transformation strategies to more efficiently meet growing consumer demand. While it’s unsurprising that banks made these moves during the pandemic – speeding up advances already on their radar – what banks and credit unions may not have expected was the rising specter of trust as they evolve their delivery. “U.S. financial institutions are struggling to maintain consumer trust in an increasingly volatile market environment,” finds Insider Intelligence in their U.S. Banking Digital Trust Benchmark Report. “That trust is even more precarious in digital channels, where there’s less human touch…”

At the same time, fintechs and payment companies continue encroaching on banking’s traditional turf, including in trusting relationships. “For the first time, consumers ranked PayPal above their current bank or credit union as their most trusted provider for banking services,” according to the Insider Intelligence analysis. “Our research shows that financial institutions in the U.S. are at a pivotal moment in their journey to earn the trust of their customers.” But the standings of individual institutions show that neobanks overall still have a higher hill to climb in fostering trust – with incumbent banks taking the top three spots in the report’s bank ranking, winning even in “neobank fortes like Feature Breadth and Ease of Use.”

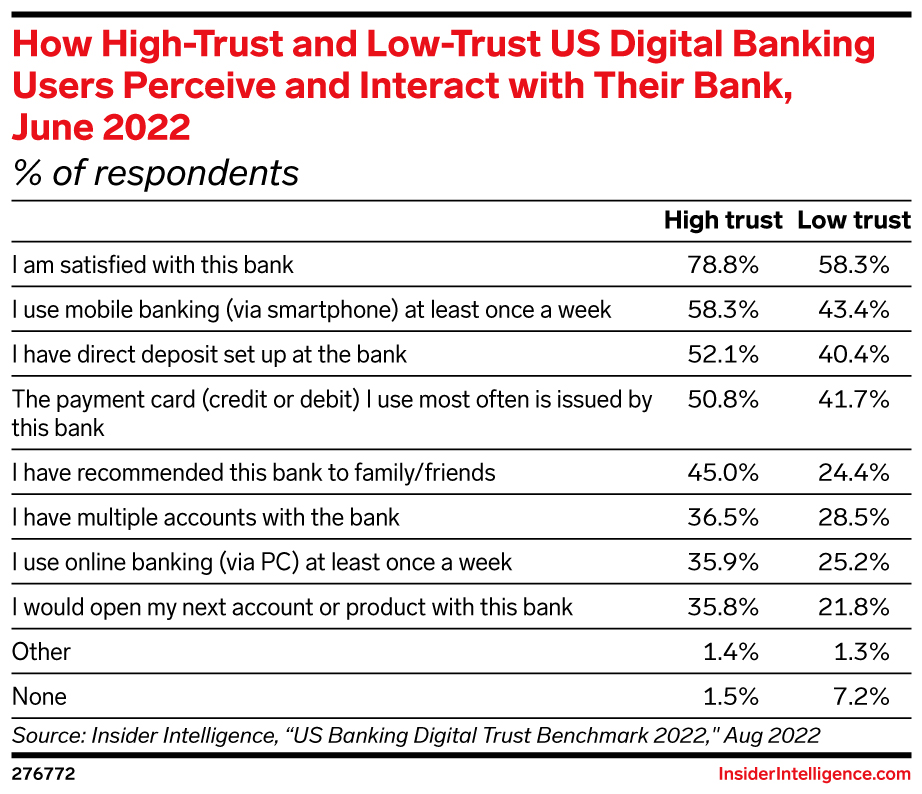

The report goes on to explore how consumers they dub “high-trust users” interact with their FIs in ways that offer greater prospects and long-term relationship potential than users with low trust in their banks. These opportunities include recommending their bank to family and friends, holding multiple accounts and opening their next product or account with their trusted bank. “Trust is FIs’ most valuable commodity,” according to the Digital Trust report. “Without it, the premise of their business collapses. And it’s even more essential in digital banking, which is low touch and anonymous.” The report finds that consumers who exhibit high trust in their banks “show more digital engagement, satisfaction and loyalty.”

One bank at the top of Insider Intelligence’s Banking Digital Trust ranking and Investor’s Business Daily Most Trusted Financial Services competition seems to set the standard for trust in our new normal. Capital One was the first major bank to eliminate overdraft fees and make major digital investments during the pandemic. “Earning trust requires we hold ourselves accountable and constantly ask where and how we can do better,” says Andy Navarrete, Capital One’s head of external affairs in Investor’s Business Daily. “We strive to earn trust by listening to customers to understand their needs, and ultimately, by designing and offering products, services and technology that help them thrive and unlock their full potential.”

Insider Intelligence concludes that financial institutions that center trust as a crucial differentiator during challenging times “can emerge with stronger-than-ever customer relationships and bottom lines.” For more information on building trust in post-pandemic banking, stay tuned to Believe in Banking’s continuing coverage of the industry’s top trends and topics. For insights on best practices in financial services, including strategies built on trust and transparency, contact the banking and credit union experts at Adrenaline via email at info@adrenalinex.com.