From digital channels to relationship banking, learn how putting the customer at the center of organizational change can fortify financial services for what’s next

There’s no doubt that COVID has been accelerating the pace of change across the consumer landscape, and financial services are no exception. Today, the status quo in banking has been pushed aside and replaced with a more responsive consumer model where channels are scaled, resulting in banking stepping up as agents of a change – not exactly a comfort zone. Whether it’s consumers relocating or digital banking ubiquity, the pandemic is providing impetus for transformative shifts in banking, not all of which are based on digital convenience or speed. In fact, relationship banking that’s customer-centric as a core competency is a strategic foundation that works now and builds toward the future.

Beyond Data, Beyond Digital

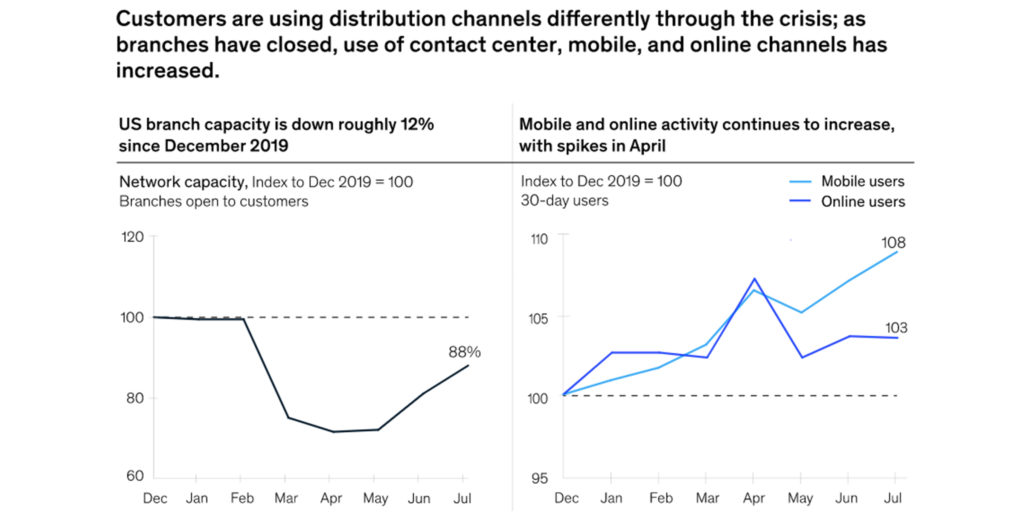

In the recent report “Transforming the US consumer bank for the next normal” McKinsey says, “A ‘wait and see’ approach to transformation will not work for banks. Instead, it is a moment for radical creativity. Banks that reimagine how they engage their customers and empower their employees will emerge as leaders.” While this forward-facing consultancy may appear to be advocating wholesale digital transformation, that’s only part of the story. An industry that was overdue for change, banking embracing data (big and small) to understand behaviors and engage with customers sells itself short if it only uses those insights to better its mobile app or online banking platform.

It’s worth noting that banking is not alone in its struggle to become more customer-centric. In “6 Ways to Build a Customer-Centric Culture” Harvard Business Review discusses how brands have been trying to become more customer-centric for more than two decades, but that several issues intersect to make it more difficult, not the least of which is data. They say, “The volume, velocity, and variety of customer data that now exists overwhelms many organizations. Some companies don’t have the systems and technology to segment and profile customers. Others lack the processes and operational capabilities to target them with personalized communications and experiences.”

Creating Connections

Even if organizations don’t know exactly how to implement it yet, developing a strategy to become more customer-centric pays off. In fact, McKinsey data finds “A fundamental change of mindset focusing on the customer, along with operational and IT improvements, can generate a 20 to 30 percent uplift in customer satisfaction, a 10 to 20 percent improvement in employee satisfaction, and economic gains ranging from 20 to 50 percent of the cost base addressed in the various journeys.” When viewed from the lens of the consumer, a brand that knows you and what’s important to you feels more connected and is better positioned to deliver more value and build more trust.

According to “Why a Customer-Centric Banking Model is Essential,” Hitachi finds, “Customer-centricity isn’t as simple as asking customers what they want and making good on it, though that’s certainly part of it. Customer-centricity requires banks to re-evaluate what they know about their customers and to better understand who their customers are, what interests them, what they value, and what drives them.” In short, a focus on customer centricity builds trust. While there has always been a trust versus time divide in banking – with trust creating deeper, more valuable connections – what customer-centricity allows banks to do is bridge the divide between the two, building trust while optimizing time.

Key Drivers

While most organizations cannot build an enterprise-wide approach to data integration and customer-centricity at this moment, they can begin to calibrate toward it. This is based on a fundamental idea, core to customer-centricity: The goal is not “selling more” but rather “providing more” value to the consumer, and if there is one advantage that community banks and credit unions already have over their bigger competitors, it’s deeply knowing their customers and their communities. Many financial institutions are already customer-centric, and simply need to round up their actions into a cohesive data-based strategy.

Steps all banks – large and small – should be taking to maximize this moment and enhance customer centricity include:

- Leverage your culture – Ensure that your team is aligned with the customer-first mission and live it with every customer interaction.

- Provide trusted counsel – Define your current and future model around providing valuable consultation, especially during these challenging times.

- Deploy data insights – Even the smallest organizations have customer data at their disposal. Use it to create responsive and targeted products and services and marketing messages that meet a true need.

- Calibrate banking systems – All bank processes should be built in response to consumer needs, not just the bank’s operational and functional necessities.

- Prioritize customer experience – Know the difference between UX, CX, and BX and ladder experiences accordingly. Even BX should map back to a customer-centric mindset.

When developing a customer-centric mindset and the strategies that follow, it’s important to remember that the banking industry isn’t immune to wider consumer trends. What people are able to do in retail, healthcare, or entertainment impacts their expectations of what banking can and should deliver. To begin developing customer-centric strategies in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903. For more information on bank branch reopening in the post-COVID landscape, download the Roadmap to Reopening.