At the start of the new year, two overarching themes are defining the banking environment

Throughout the last year, compelling data and detailed analysis showed that branches were on the precipice of a revival. Now, all indications point to 2023 as the year of the branch. In fact, expansion efforts from community banks and credit unions show the central role of the branch as they develop their customer-first strategies. Even while they close some branches, banks are investing in new locations to ensure they have the right branches in the right places, with advice around the corner. “In 2022, we saw a big push to make branches into spaces that advise rather than sell to clients,” according to the ATM Marketplace article on banking trends in 2023.

Moreover, data shows the increasing influence of the branch, even among the youngest demographics. “[W]hat we found was even younger people, want to have a conversation for complex products,” says Mike Abbott, Accenture’s global banking lead in American Banker’s podcast. “They want to get back and have a conversation with a banker again.” Instead of viewing bank branches as “vaults,” Abbott says they should be thought of as Apple Stores. “They become places of conversation to help find the right product, the right loan, the right offer – to bring all that together and having that conversation becomes much more important.”

Speaking of younger consumers, Gen Z has fully arrived as the demographic making its mark on financial services in 2023, especially as it relates to delivering enhanced experiences. “Gen Z is the new desirable demographic for banks and financial institutions,” according to Insider Intelligence. “Firms must act now to nab these digitally native customers.” Technology solutions will be only part of an appeal to younger customers, though. Even as digital-only banking continues making inroads into banking, people still prefer known institutions over upstarts, with 65% of U.S. consumers reporting they would feel more comfortable banking with an online bank that’s associated with a traditional financial institution, according to the Harris Poll.

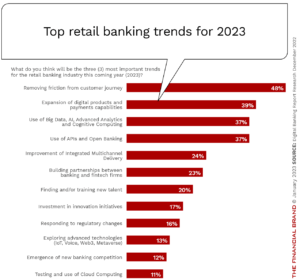

Finding the right balance of branch and digital banking continues to be the industry’s charge, developing into the more mature experiences that Adrenaline’s Ben Hopper says blends “digital with physical channels and taking the best aspects from each.” In fact, the Financial Brand’s Digital Banking Report finds that this balancing act requires institutions to go beyond omnichannel. “Unlike previous periods, where most organizations simply modified previous strategies, the industry as a whole seems to be significantly increasing the focus on some key trends that will have lasting benefits and help organizations become increasingly future-ready.”

For the latest on banking priorities throughout the year, stay tuned to Believe in Banking’s continuing coverage of top trends and topics. For the banking industry’s best practices, visit Adrenaline’s Insights. And if you’re a banking leader looking for brand to branch strategies customized for your institution, contact our banking and credit union experts via email at info@adrenalinex.com.