Data from J.D. Power finds declining customer satisfaction for branchless banks

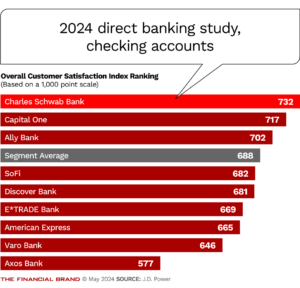

Following the rising tide of online only banks, especially during Covid, consumers have become less enthused about their banking experience with branchless banks in today’s environment. New data from J.D. Power finds sinking satisfaction for online-only banks, with scores down 27 points over 2023 levels. Rates and customer service seem to be at the heart of much of the decline, according to the company’s analysis. “[C]ustomers who experienced problems had a very tough time resolving them in a timely manner, causing satisfaction with ‘ease of problem resolution’ to decline sharply,” says Paul McAdam, J.D. Power’s senior director of banking and payments intelligence.

In an interview with the Financial Brand about the study, McAdam says that overall customer service issues were less prevalent this year, but customers had a harder time getting a resolution. “Fewer customers actually had problems, says McAdams. “But if customers needed support of any kind, and particularly if they had a problem, it just went downhill.” Conversely, branch banking satisfaction is high because of an institution’s interactions with customers, not despite them. According to the ABA Banking Journal on branch banking experiences, “Customer satisfaction with retail bank branches is much higher than average when banks deliver the fundamentals of customer service.”

Like digital banking, customer service is table stakes in banking. Getting an issue resolved matters, but what matters even more is easily connecting to a knowledgeable expert. Reaching a human – at the branch, via chat or on the phone – when customers need support is essential to a good banking experience. This reaffirms what customers consistently report – that they want to bank how, when and where they want, with customer service and consultation readily available. According to Believe in Banking reporting on engagement, “High-value consultation is at the heart of creating engaging customer experiences, as digital and mobile banking take on the bulk of transactions.”

If you’re a financial services leader wanting to deliver better banking experiences, get in touch with the banking and credit union experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.