Amid rising costs for financial services and ongoing economic pressure, consumers looking to their banks and credit unions for consultative support

As Americans continue to grapple with inflationary pressures across the consumer landscape, new data finds double digit increases in year-over-year financial services spending. “Americans paid 14% more for financial services last year, driven by rising interest rates on loans, increased borrowing and, to a lesser extent, higher fees on deposit accounts,” according to reporting in American Banker. “Altogether, this paints a picture of debt that could really start to strain the checkbooks of American families,” says Meghan Greene, senior director of policy and research at Financial Health Network, a nonprofit focused on improving financial outcomes for Americans.

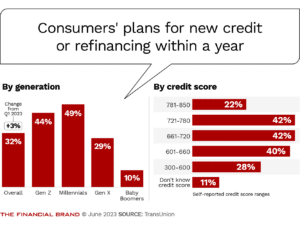

How consumers cope with any budgetary pressure like this is through a “three-legged stool,” leveraging a mix of salary, savings and credit, according to reporting on research from TransUnion. The latter – credit – is on the rise, with one in three people planning to borrow, despite easing inflation and stabilizing interest rates. “We are living in unchartered territory from a consumer credit perspective, says Charlie Wise, SVP and head of global research and consulting at TransUnion. “The combination of rising interest rates and elevated inflation, while not uncommon from a historical perspective, is an unfamiliar experience for many consumers.”

As people pay more for financial services and tap into credit to make ends meet, it’s clear that consumers need more financial tools and better fiscal guidance from their bank or credit union. Not only is it what consumers demand, it’s exactly what institutions can deliver to drive greater affinity.“Customers who feel that they receive good advice and support from their bank are much more likely to stay loyal and use more products,” finds the Financial Brand. “Banks that can help their customers navigate difficult financial times and provide useful and timely advice can gain a competitive advantage and create stickier and more profitable customers.”

High-value consultation is at the heart of creating engaging customer experiences, as digital and mobile banking take on the bulk of transactions. “Customers demand better service in the form of a more personalized experience and customized solutions that fit their current financial state,” according to reporting on better banking experiences. Especially following this year’s bank failures, community banks and credit unions can use their inherent strengths to their advantage, advises Insider Intelligence. “Small banks’ and credit unions’ ability to form close relationships with people in their communities gives them a major advantage over big banks.”

If you’re a banking leader looking for strategies customized to your financial institution, get in touch with Adrenaline’s banking and credit union experts. And, don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking industry.