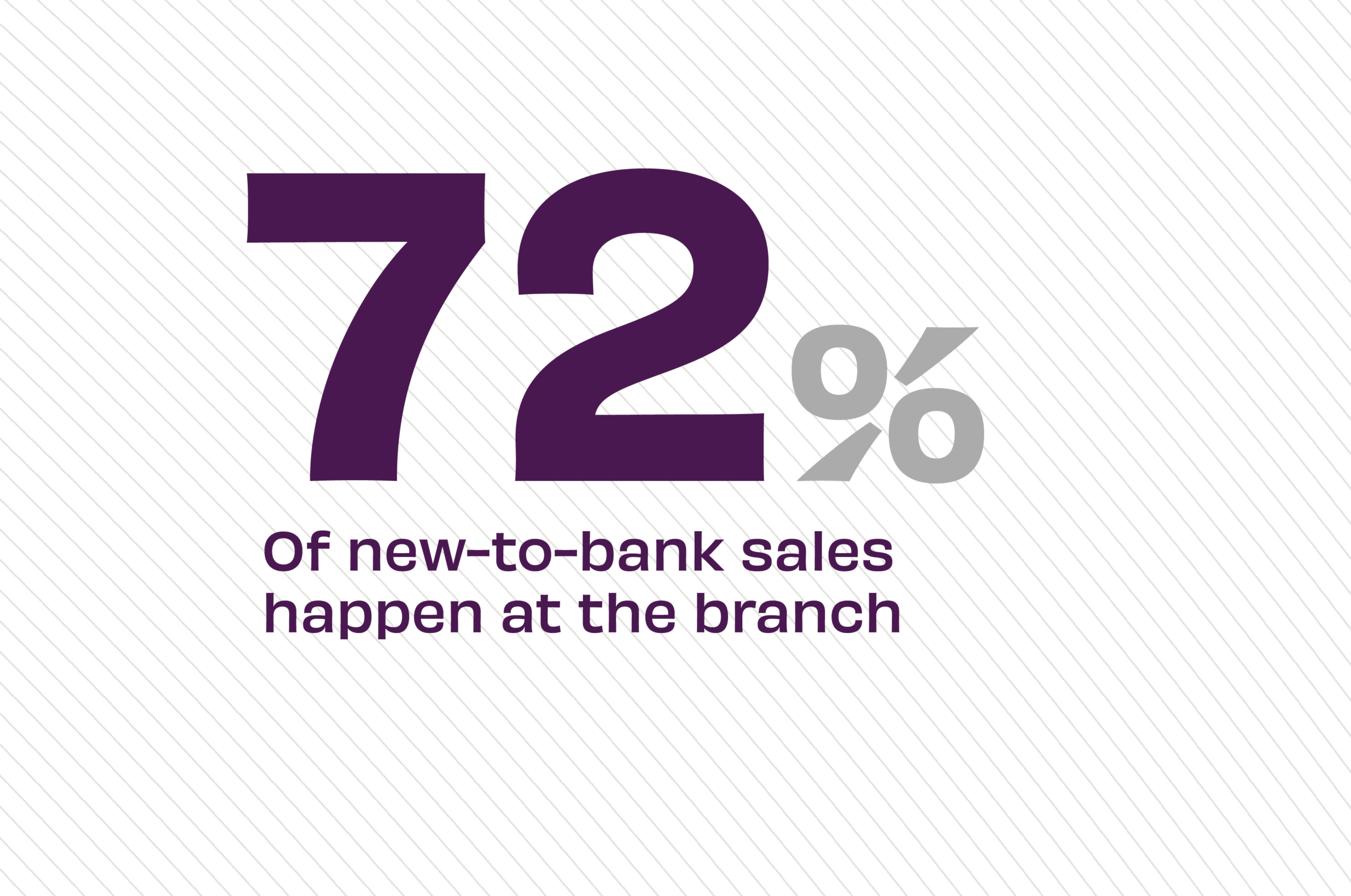

The Story:

Despite the upsurge of digital channels for banking transactions, branches remain the primary driver of new-to-bank sales for financial institutions. While consumers love efficiency tools for processing transactions, banks and credit unions won’t win over new customers with an awesome new website or slick mobile app. That’s because the primary purpose of digital channels is to support existing customers with their everyday transactions, not attract and acquire new ones ready to begin their banking relationships.

The Takeaway:

The branch is simultaneously a powerful revenue generator for institutions and the way consumers prefer to open new accounts with their new bank of choice. To maximize growth, banks and credit unions must focus on in-branch cross-sell potential. But there are functional considerations that could be holding financial institutions back. “The traditional branch sales model was based on cross-selling to customers who used the branch for transactions,” according to BAI Banking Strategies. “But the typical branch only sells about one new product per personal banker per day, so it’s critical that branch managers establish and maintain disciplined processes” to deepen relationships and maximize cross-sell at the branch.

Source: McKinsey, “The State of Retail Banking,” October, 2024 and BAI Banking Strategies, “Improving the Branch Sales Process,” June, 2022