The Story:

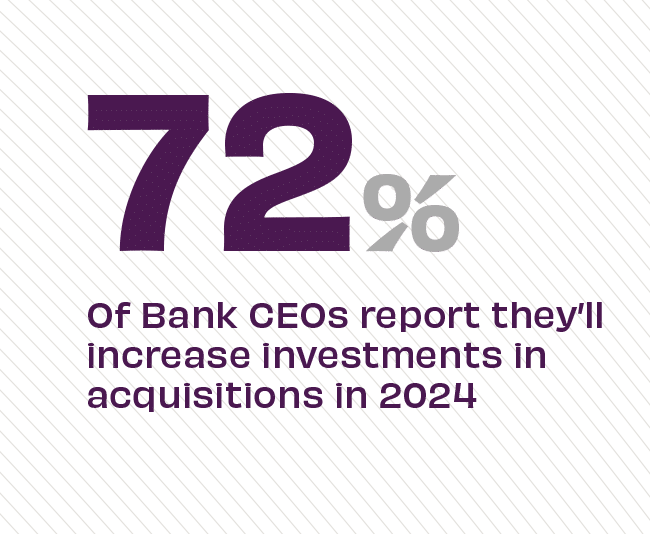

After a slowdown in banking M&A activity last year, bank CEOs are eager to resume their focus on growth in 2024, according to new industry data from Ernst & Young. The most recent CEO Outlook Pulse Survey finds 90% of financial services chief executive officers are planning to engage in M&A in the coming year, and by the looks of it, they plan to be on the acquiring side of those deals. In fact, more than seven out of ten banking leaders are increasing investments into acquisitions over the next twelve months.

The Takeaway:

According to American Banker, M&A momentum is on the move in large part “because of heightening buyer interest.” For many banks, scaling their institutions through acquisition is the key to remaining resilient. “Conversations I’ve had with forward-thinking FIs have centered on where they need to invest today to be one step ahead of their competitors tomorrow,” says Sid Khosla, EY Americas Financial Services Strategy and Transactions Managing Partner, in his 2024 banking roundup. “From an M&A perspective, this means translating their roadmap into tactical and strategic opportunities to drive long-term value creation.”

Sources: Ernst & Young, “2024 CEO Outlook Pulse Survey,” November, 2023; American Banker, “Banks Eager to Resume M&A Predict ‘Wave of Consolidation’ in 2024,” November, 2023; and Ernst & Young, “Perspectives on Financial Services M&A in 2024,” November 2023