How financial institutions can compete with challengers and leverage data and opportunities for growth

With the unbundling of financial services, challenger banks pin their success on peeling off core customer functions – like peer-to-peer payments, buy now, pay later loans and app-based loyalty programs – to deliver the speed and convenience consumers prize. But banks have a distinct advantage over their non-bank peers: customer trust. As we reported in Fundamental Values: “In account opening – a key metric for bank and credit union success – consumer trust continues to be the driving factor, and here, traditional financial institutions have a significant advantage…” with 40% of people citing brand trust as the reason they choose a primary bank account.

Further, most consumers remain reticent to change – deterred by the inconvenience and time it takes to choose a new primary financial institution – although 12% of U.S. consumers report they do plan to make the switch in the coming months. While consumers are still loyal to their current banks, that doesn’t mean that they won’t use a neobank or other provider for what they see as an attractive à la carte offer. In fact, a new survey from Plaid finds that 88% of Americans use at least one fintech product to meet their financial needs, despite their loyalty to their primary financial institution.

As consumers seek out additional providers to fill in the gaps in their financial lives, fintech is delivering. “As far as why consumers have increasingly flocked to fintech apps, 93% reported that it saved them time,” finds Fortune. “While 81% said it gave them more control over their finances, and 78% said it saved them money.” The global report from Bain calculates the hidden cost of this defection, noting that between 25-51% of all banking products sold now go to non-primary FIs. The bottom line? People stick with their bank for checking accounts, and load up on apps or challenger products for investing, payments, financial planning, and even mortgages.

Opening Up Opportunities

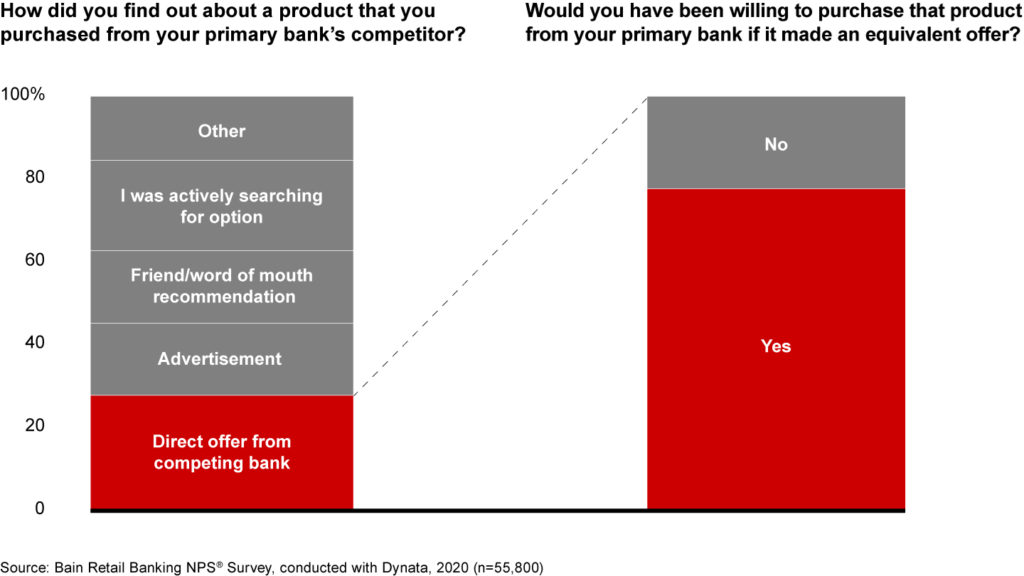

Rather than looking at a divided pie between traditional financial institutions and fintechs as inevitable, data shows that offering more products and services to current customers bear fruit for banks. In advancing these opportunities, Bain finds that most consumers would happily purchase more from their primary FI if they made a personalized offer at the point of need. In fact, 78% said they were willing to buy the same product or service from their primary bank if it made a compelling or equivalent offer. An added consumer benefit would be products that are highly integrated into a consumer’s existing banking tools.

Certainly, to remain competitive banks must continually develop relevant banking products to meet the market. For many, though, they already have the in-demand products, but just haven’t gotten them to the people when they need them. In Personalizing the Customer Experience, McKinsey says, “Organizations that are leaders in personalization differentiate by creating customized recommendations, reaching the right individual at the right moment with the right engagement communication.” Excelling at personalization means more business, with companies generating 40% more revenue in all industries when they do it right.

Personalization Pays Off

Digital natives expect brands they interact with to use personalization as an effective way to deepen the relationship. After all, a mix of customer data, predictive AI, and automation often serves up amazingly accurate offers. “For financial institutions looking to capture the Millennial and Gen Z demographic, it’s increasingly important to rethink acquisition approaches and prioritize automated, hyper-personalized programs,” says American Banker. So routine are personalized programs today that 72% of consumers of all generations “expect businesses they buy from to recognize them as individuals and know their interests,” finds McKinsey.

“It all comes down to smarter marketing,” says Juliet D’Ambrosio, Senior Director of Strategy for Adrenaline. Does that mean simply getting personalized offers to customers at the right time; doubling down on a more responsive, empathetic service model; or bringing like-minded people together to learn about financial wellness topics linked to life stages? “We think it’s all of the above and more,” says D’Ambrosio. To do that, banks need better data and a well-rounded, responsive approach for activating it, resulting in more opportunities and better overall performance.

“Many financial marketers are using outdated methods to connect and engage with customers, focusing too heavily on outdated tactics like email marketing campaigns,” according to Arizent research on the digital marketing gap. “Relatively few financial marketers have sustainable data-driven approaches, despite prioritizing technology investment and leveraging digital channels.” Data to inform decision-making at speed for how, what and to whom to market has never been more critical and will be a deciding factor for how competitive traditional FIs can be. Additionally, holistic marketing strategies based on full customer journeys will help banks and credit unions identify those vital “product moments” to help build even more customer depth and loyalty.

Stay tuned as Believe in Banking provides news and insights on the industry’s latest developments, like ubiquitous banking. For insights on best practices in banking, contact the banking and credit union experts at Adrenaline at info@adrenalinex.com.