How banks and credit unions can lead the path forward by embracing a banking-for-good model

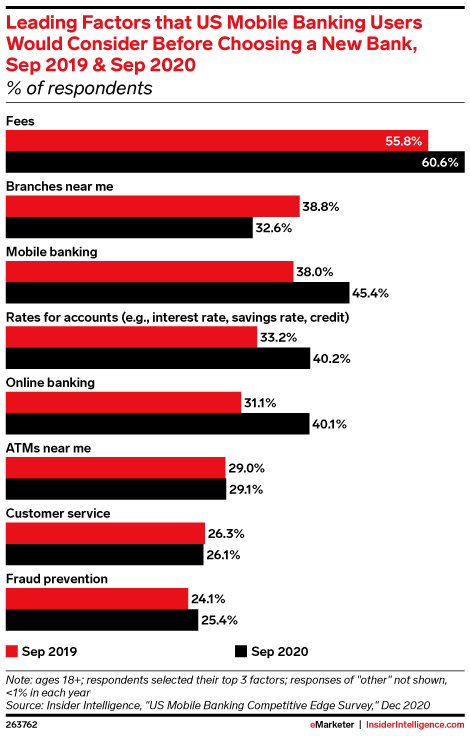

The year 2020 was a watershed moment. For financial services, COVID upended traditional wisdom about how banking should deliver its services and transformed the way consumers think about money at the same time. Now, we may be seeing a final shift away from the fee-driven model that has defined much of banking’s income for decades. In other words, “When it comes to universally irritating fees, banks may have written the playbook… without threat from other competitors” according to an ETF Trends article on fintech’s influence on fees. What developed was a fee-for-service model that defined how financial institutions provided banking services for the last 100-plus years.

While this approach began as a way to simply compensate banking for its costs, it evolved to become a profit center, particularly for lucrative overdraft fees. American Banker puts it this way: “For several decades, U.S. banks reaped huge revenues from fees charged to customers who spent money they didn’t have, while also enduring a consumer backlash that tarnished their reputations.” But for rising numbers of financial institutions, especially mid-sized and larger banks, “the calculus is changing.” Now that digital-only banks like Ally are making their COVID relief permanent by banishing overdraft fees, the conversation has shifted toward ways to support consumers, especially those hardest hit by fees.

With banking fees that can cost consumers upwards of $1,300 a year – a burden disproportionately affecting low-income and nonwhite customers – it’s not just those outside financial services calling for change. “This economic reality is why I’m calling for a fundamental rewiring of how we design, build, and run financial services,” according to Brandon Krieg, CEO and co-founder of Stash, in a Fast Company article on creating more equity in financial services. “It’s why I’m fighting for innovation that meets the urgent needs of everyday consumers. It’s… why I’m asking financial institutions not to sacrifice empathy for profit.”

Empowered Consumers

Pandemic-driven challenges to banking’s status quo may provide a roadmap to financial services’ future. As consumers, digital adoption ramped up during COVID and information on avoiding banking fees and new offerings like PNC’s low cash mode become more accessible to consumers, banking sits at the precipice of change. Interestingly, it’s COVID that broke the decades-long trend in overdraft revenue – with support from government stimulus checks and banks’ forgiveness programs to help consumers. “Banks must handle the truth: Fees aren’t coming back to pre-pandemic levels,” according to Business Insider in their article on banking’s need to diversify.

The business news platform says larger banks can use their larger size and product diversity to move away from fees. “Because they are less dependent on income from service charges, larger banks could exploit this shift to encourage customers to engage with personal finance management (PFM) tools.” For smaller FIs, the scale does provide a challenge to revenue, so BI recommends that they look to scrappier startups for inspiration. Further, don’t discount the built-in advantages that community banks and credit unions can leverage to broaden their base and foster banking for good, namely leveraging high levels of consumer trust and building deeper bonds through community investment and personalized experiences.