Best practices for creating common bonds between people and their financial services providers

As consumer sentiment shifts post-COVID, one out of every ten people are considering switching their primary financial institutions within a year and opening new accounts to meet the financial essentials and align with the values in their lives. At this critical inflection point, the need for financial services providers to build deeper bonds with consumers has never been more pressing, as people increasingly view their banking experiences through the lens of personal experiences. Deeper than local giveback programs and neighborhood (re)investment, community building goes beyond the boundaries of geographic location to create new relationships around a common set of interests and values.

Community-building taps into our individual humanity and shared experiences and builds bonds around them. This empathy-driven approach is critical in banking at all times – and especially post-pandemic – as people seek to reconnect with brands and with one another. More than ever, consumers choose relationships with brands that value their individual needs and see them not just as another customer. In fact, a recent Accenture study on empathy in banking finds that leaders who demonstrate strong empathetic characteristics outperform those who don’t with empathic leaders’ revenues growing “by an average 1.3 percent during 2020” while those who lagged behind “saw a contraction of revenues by 0.6 percent on average.”

Beyond performance, financial institutions find greater meaning and more loyal, long-term, ‘stickier’ relationships through community building – relationships rooted in those deeper human values expressed through the power of purpose and a heart for service. Community building demonstrates that that banks and credit unions value people-first experiences, anchored in shared humanity. To help banking foster these deeper connections, we’ve rounded up five of the best practices for building community in banking.

1. Build Around Affinity

Affinity groups are communities of people who have “shared interest, goal, values, identity, or life experiences.” Often known as tribes in the marketing world, affinity groups typically come together organically through people’s shared interests, as evidenced by the popularity of the social platform Meetup. Institutions that build community around affinity most often center around people’s passions or lifestyles. A recent credit union digital ad campaign saw success building on such affinity. “Demonstrating that Town & Country Federal Credit Union sees their audiences, the programmatic lifestyle ads are based on and built out of data. As an outgrowth of the attributes found in data analytics, the campaign would be both aspirational and affirmational.”

2. Build Around Life Stage

Different than lifestyle and generational attributes alone, life stages lean in on aspects of both for their relevance, but remove overbroad generalizations inherent in each. According to an article on life stage segmentation: “Consumers in the Millennial age generation could currently be going through one of the following life stages: college, moving out, getting married or having kids. An effective message to a Millennial in college is not the same message as a Millennial who is having kids.” Life stage communities are instead built and based on “key milestones” in people’s lives. Valley Strong’s recent campaign demonstrates life stage awareness via personalization that deepens community. Upon entering a new market, the CU “leaned into getting to know its new neighbors a little better and showed its interest in them through an insightful, audience-led digital marketing campaign made just for the market.”

3. Build Around Values

Whether it’s communities built around innovation like what BankMobile is doing with its college-based program or groups built around giving back, values-based community building unleashes the power of purpose for organizations and individuals alike. Building communities around organizational values, financial services brands can wear what’s important to them right on their sleeves. IncredibleBank is doing just that with its food-based program, Incredible Giving. Their program to provide 500 meals for every loan closed resulted in in 958,000 meals donated to Feeding America in 2020. So deep is their commitment to food security for their communities, they run a 15-acre farm in Wisconsin and donate the food grown there to local food banks and provide volunteers to the same food-based organizations.

4. Build Around Expertise

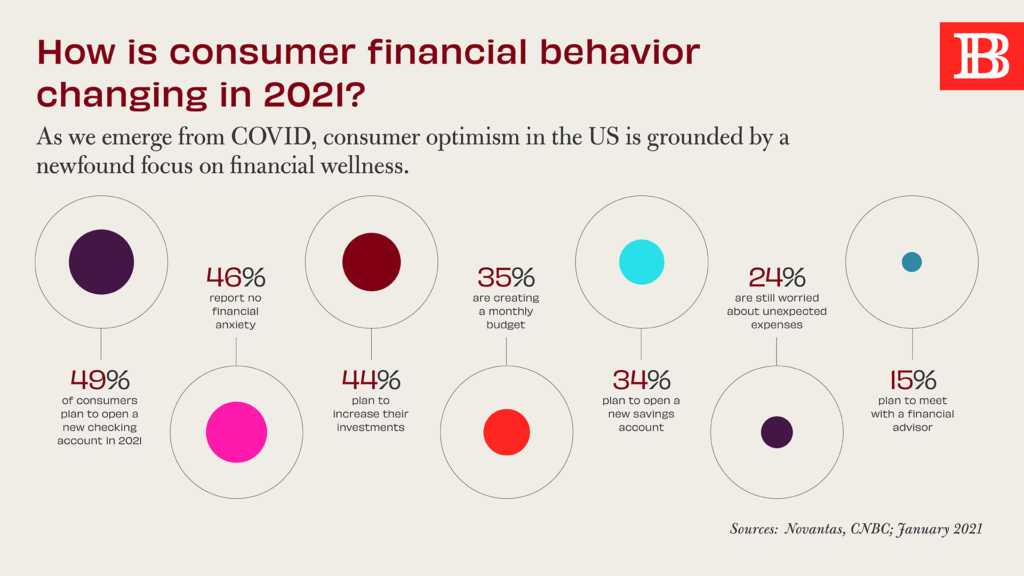

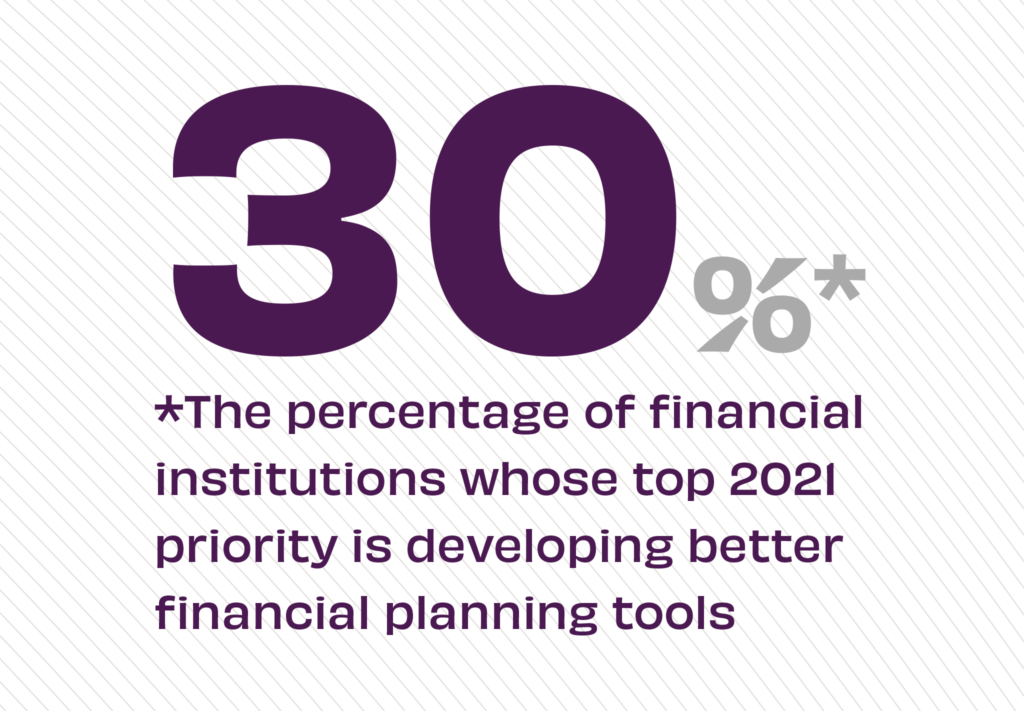

As consumer need for financial wellness is rising, banks and credit unions are stepping up with programs to help. Leveraging their deep expertise and experience in helping consumers meet their financial goals, “providers like banks and credit unions are redefining how they deliver consumer value, and in turn, reawakening their own set of purpose-driven values.” With nearly half of all consumers ranking financial wellness as a top priority in 2021, organizations like KeyBank are providing platforms with critical consumer information debt, credit, saving and budgeting. Marking the annual Financial Literacy Month this April, all manner of financial services sector companies are responding to consumer need, but banking has a unique position of strength from which to build community.

5. Build Around Local

Finally, what usually connotes the “community” in banking is the focus on local values. Right in your neighborhood, hometown banks and credit unions celebrate their commitment to community in a way that larger national organizations can only covet. As one of the key differentiators between big banks and local institutions, ICBA outlines community banking’s value proposition: “Community banks are an integral part of Main Street; they reinvest local dollars back into the community… Their relationship banking philosophy is ingrained in the way they conduct business, one loan – one customer – at a time.” Examples of banking’s local focus on community building are all around us, from meeting consumers’ post-pandemic values expectations to ways that banking can help transform people’s lives.

For more insights on building community in banking, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services. To develop meaningful experiences for customers and members, especially in the wake of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.