Experts weigh in on current market conditions and a path forward for banking growth in a socially distanced world

While the immediate aftermath of COVID’s shutdowns put several big banking M&A deals on ice this summer – like the Ally Financial and CardWorks $2.7B merger and the Texas Capital and Independent Bank $5.5B merger – many analysts are expecting merger and acquisition activity to pick back up, even as the pandemic wears on into 2021. The pressure for banks to optimize and operationalize have only increased during COVID. According to Sean Keathley, president and CEO at Adrenaline, “Scale continues to be a big issue in banking, and the pandemic has made it even harder on banks. The reality is that you need to be a certain threshold of size to survive.”

Banks that have stagnated or decreased in value during COVID will need to consider acquisition by another organization, and there is evidence that M&A activity in banking has already started to pick up steam. In fact, on a recent Marketplace broadcast, Steven Davidoff Solomon, professor of law at UC Berkeley, says companies flush with cash will be in a position to purchase ones that are struggling. “They are all circling right now, and they are going to come in to pick up the pieces,” he said.

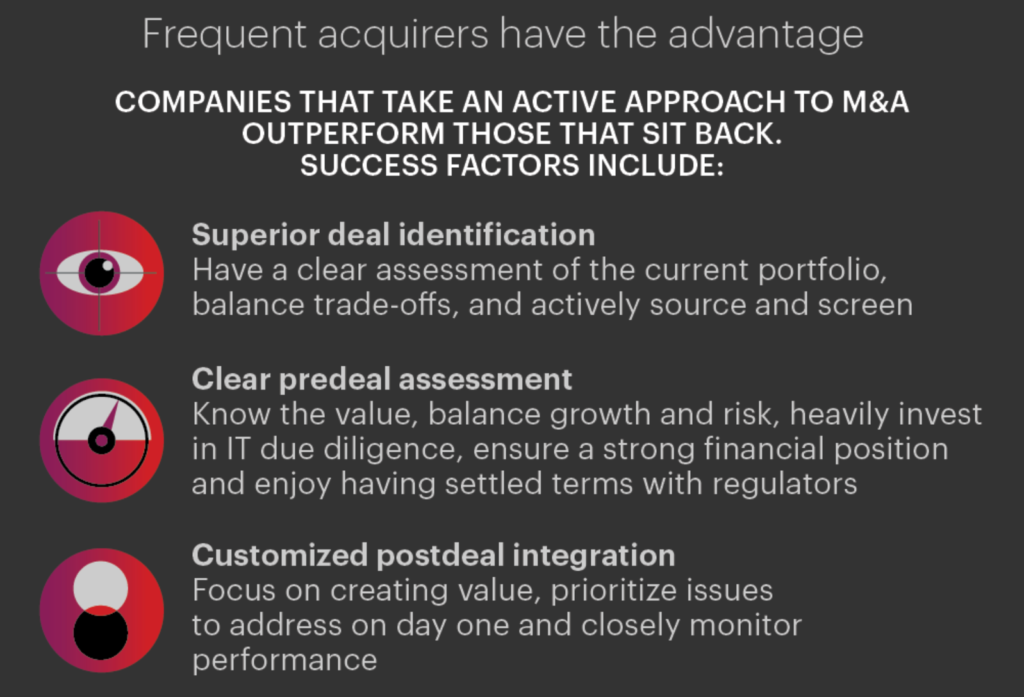

Global consultancy Bain is also quite bullish on M&A activity in the banking sector in coming months, calling it a “coming wave” and saying that “Covid-19 will spur further consolidation, and the most active acquirers have a leg up.” But while banking has been increasing its reserves in the face of the pandemic, companies may still be reticent to take a leap right now with the full economic forecast still unknown.

Lee Burrows, vice chairman of investment banking at Performance Trust Capital Partners, describes the COVID-era M&A landscape: “The economy has held up pretty well through the third quarter of 2020. But there is a bit of uncertainty about whether that’s going to hold into 2021. So, some banks want to have a little bit of war chest, and they figure if they don’t have any asset quality problems and they’ll have an additional level of capital that they can use to grow their asset base. Maybe they will make some cash acquisitions of other banks, acquire branches from another company or even enter a new market, de novo.”

A Path to Value

The bottom line for banking is that merging is a conduit to growth. Adrenaline’s Keathley says, “Since the crash of 2008, banks have gone from ‘too big to fail’ to ‘too small to survive.’ The bottom line is M&A empowers banks to scale. It’s a path to value.” Whether it’s augmenting a bank’s technology offering or looking for growth markets through branch networks, banks seeking to scale their organizations often look at acquisition as a way to generate and sustain growth.

According to management consultancy BCG, “[S]cale has always been a driver of value in banking, but it is more critical than ever because of the need for investment in technology and digital capabilities.” Despite the significant brand challenges with M&A, uniting forces is often one of the best strategies for facing the unknowns of the economy as we enter 2021. BCG finds that requisite credit reserves and a low-rate environment may result in more deals in the long-run.

Looking Ahead

In the coming months, M&A will likely focus on strategic leveraging of market and economic dynamics, but not necessarily those coming from COVID. Sometimes it’s other mergers that provide opportunity to move into a new market. According to Burrows, “The BB&T-SunTrust [Truist] merger has shaken a lot of bankers loose… good bankers in other markets. So, a bank may decide that they’re going to enter that market by hiring a team and build around that team.” Some of these market entries may not even begin as a full-service branch, but rather, as Burrows describes, building around talent. “Maybe they’ll start off first as a loan production office. Once they reach a critical mass, they can go in and open a full service branch.”

Given the powerful role of the local branch network, Keathley says he’s expecting to see more surgical and precision deals in 2021, where a bank buys another bank’s branches without necessarily merging or acquiring. COVID has caused a shakeup in where we live and work and the resulting real estate market is full of opportunities. Keathley says, “You may not have been able to get into an area before the pandemic, but post-COVID, an undercapitalized bank may be exiting a market that they no longer wanted to be in. Now, another bank that’s better positioned can enter that market, purchase the branches and customer relationships and position their organizations for growth. The bottom line is if you’re not thriving, you won’t be there to serve.”

Be sure to stay tuned to Believe in Banking as it tracks the big trends – like M&A and COVID as a catalyst – that are driving the financial services sector forward and influencing the banking experience. To begin developing M&A strategies in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.