Insights and information on ways financial institutions are recruiting and retaining top talent

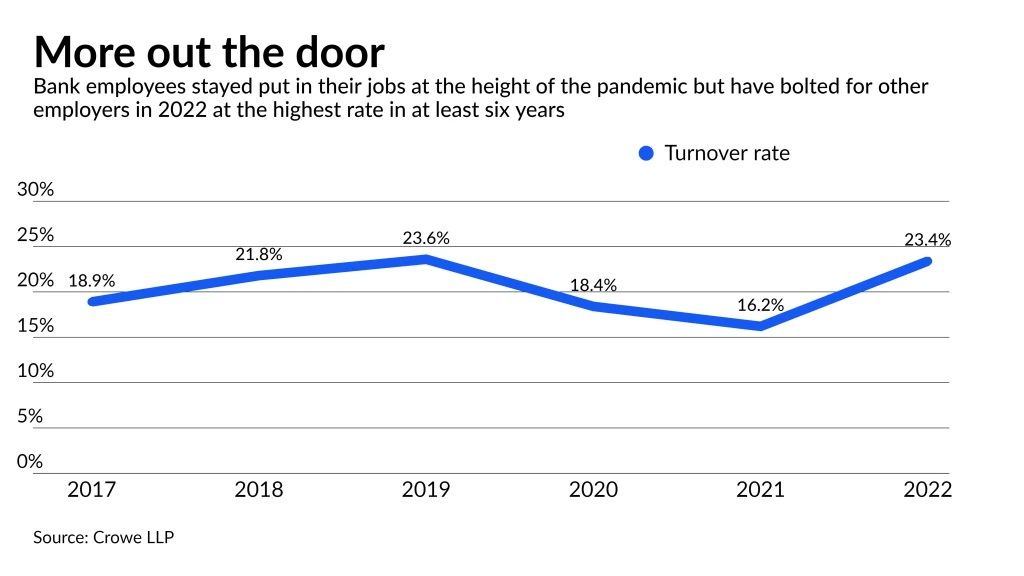

Amid fallout from the pandemic economy, banking faces an ever-tightening labor market and stiff competition for talented staff. Now, new data finds that despite substantial pay increases, employee turnover is skyrocketing for institutions of all sizes. At 23.4%, it’s more than a seven-point rise in a year. “The data shows it is becoming increasingly difficult for banks to retain and recruit talent,” says Thomas Grottke, managing director for Crowe, in coverage by American Banker. “The industry cannot compete for talent based on compensation and benefits packages alone, so organizations must work to improve their training programs and culture.”

So, what are banks doing to stem this rising tide? McKinsey recommends banks first understand the relationship between staffing and business growth. “About 50 roles drive 80% of the business value,” finds The Future Of Banking Talent. Instead of hiring based on organizational hierarchy, banks should base staffing decisions on what drives results. “In fact, 90% of critical talent is missed when organizations only focus on the top.” Recruiting for growing lending operations is an emphasis for many FIs. But focusing on the future is a core concentration, with many banks and credit unions hiring innovation workers for rising technology demands.

Recruiting and Retaining Banking Talent

While having a diversity and inclusion policy is important for how institutions treat employees once hired, how financial institutions activate DE&I to attract talent in the first place is essential. As outlined a recent article, Citigroup’s significant efforts in diverse recruitment set the tone for the overall organization. “I’m hopeful that the new goals send a signal that we want this diverse group of people to be here,” Erika Irish Brown, Citi’s chief diversity, equity and inclusion officer. “I think there’s a positive message in terms of what it implies to those who may not think banking is a career for them, or that firms like Citi want people like them.”

Where people work has become a point of contention between employers who want a return to the office and employees who prefer remote work, although younger workers report they miss workplace social interactions. In the recent Believe in Banking Podcast, cohost Sean Keathley, CEO at Adrenaline, says workplace conditions really matter in hiring and retention. “Can you recruit, attract and inspire the employee to do great things for your customer when they walk in?” On banks needing upgrades, he says, “It can be very hard in those situations when there’s two or three branches in terrible conditions. I’d argue, just give me one that is a great experience for the staff and the customer.”

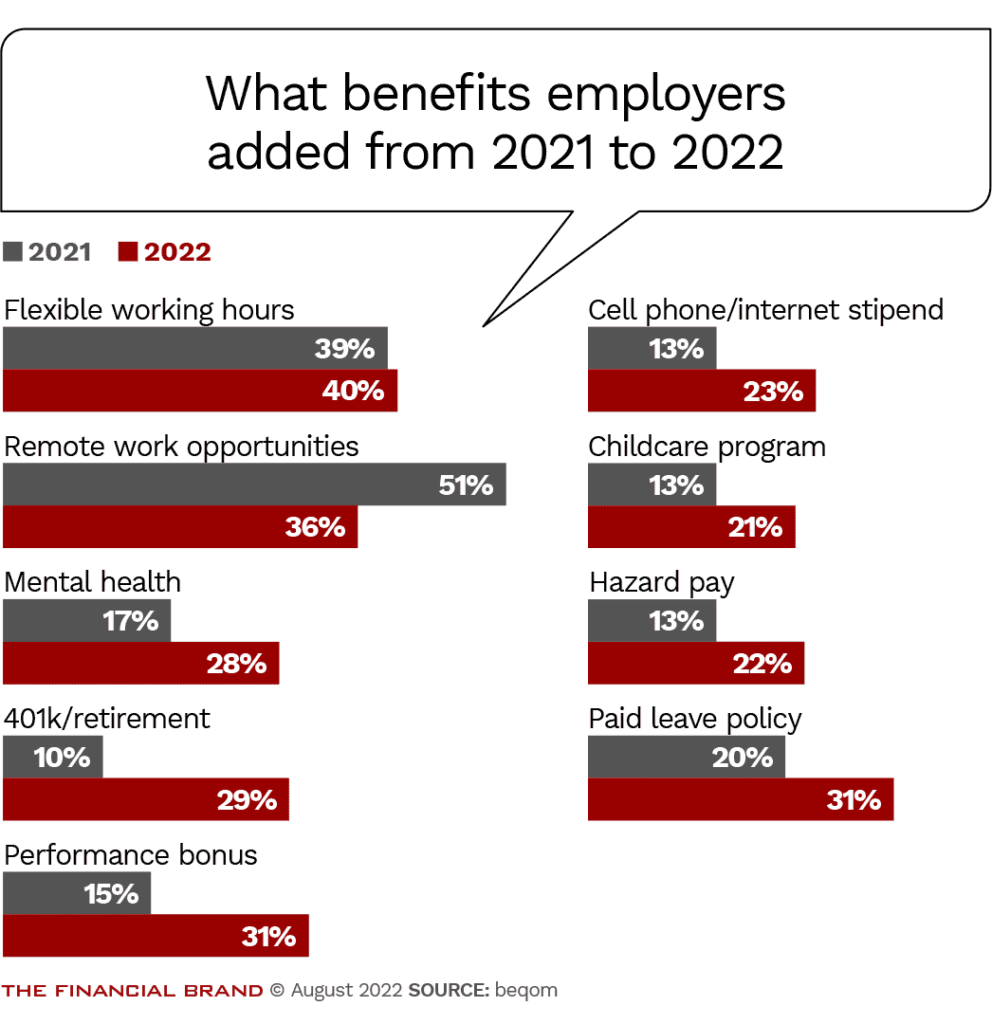

Another undeniable reality is the power shift between employers and employees with evidence found across the economy. From the Great Resignation to Quiet Quitting, employees have made it clear that they’re in the driver’s seat now. So, what can banks and credit unions do? Beyond higher pay, most are looking at a full suite of benefits to keep team members energized and engaged. Worker flexibility has risen as a key differentiator for FIs, with some even offering six-week sabbaticals for employees. Starting next year, Bank of America will offer longtime workers the time off to “reinvest in their priorities in life,” reflecting a post-pandemic shift that people work to live, not live to work.

For more information on recruiting and retaining talent in financial services, stay tuned to Believe in Banking’s continuing coverage of the industry’s top trends and topics. For insights on best practices in financial services, including effective employee engagement programs, contact the banking and credit union experts at Adrenaline via email at info@adrenalinex.com.