Second quarter earnings report show strong lending numbers and income from interest as inflationary pressure begins to ease

Economists and banking industry experts kept a watchful eye as banks released their second-quarter earnings reports, looking for signs of strength in a challenging economic environment. “Despite a first half overshadowed by heavy inflation and rising interest rates, banks are expected to report relatively resilient second-quarter earnings,” according to American Banker just ahead of the major banks’ announcements. Their predictions were largely on-point. “Second-quarter profits at all the banks were down from a year earlier, reported the New York Times. “But in some cases, the decline in profit wasn’t as severe as analysts expected.”

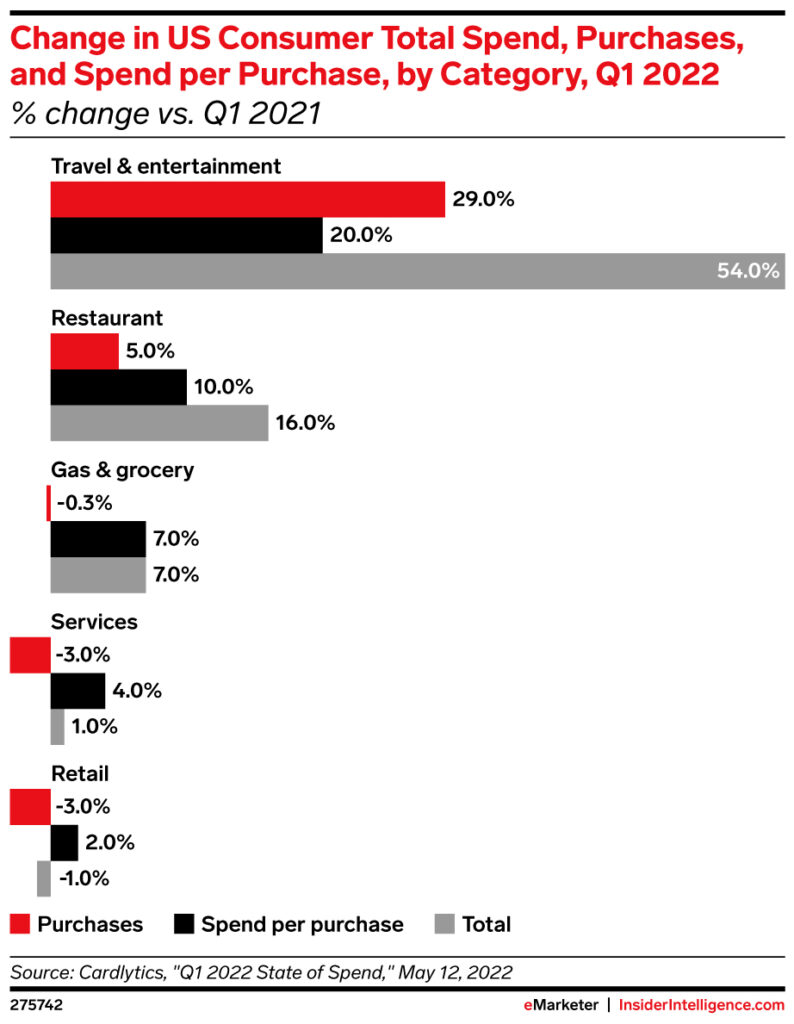

While there were profit losses, “banks reported strong lending numbers and income streams from interest income,” finds Insider Intelligence. Canadian banks, in particular, not only did not lose profit but trended upward instead, with “YoY increases in profits due to less uncertainty regarding Covid-19.” In fact, Bank of Montreal reported a quite respectable 15% increase in profits. “Despite all their talk about uncertainty, banks’ outlooks remain mostly upbeat… and positive about their ability to weather the storm” as consumer spending stays strong despite inflation and less-than-cheery consumer sentiment.

This industry news comes as overall economic indicators make a turnaround, with falling gas prices driving drops in inflation to zero in July and stocks sharply rising after a “key inflation reading showed a better-than-expected slowdown for rising prices,” according to CNBC. “I think inflation probably has peaked in year-over-year terms,” says Bill Adams, chief economist at Comerica Bank in an interview with CNN. That’s good news for banks as they make plans to support growth, pay dividends and commit to “ongoing investments in talent and technology, according to Insider Intelligence.

For more on the economic outlook for financial services post-COVID, stay tuned to Believe in Banking’s continuing coverage of the industry’s top trends and topics. For insights on best practices in financial services, including efficiency for financial institutions, contact the banking and credit union experts at Adrenaline at info@adrenalinex.com.