How trust sparks and sustains bank and credit union relationships and provides the underpinning of powerful purpose for financial institutions

As we continue coming out of our COVID cocoons, some common themes are emerging as foundational to the resumption of everyday life. Trust is one of those essential elements – in all areas – but most especially in our financial relationships. “Before the pandemic, many customers used online services to conduct low-risk activities, such as checking account balances,” according to Rene Hendrikse, who writes for Forbes on banking and the economy. “Lockdowns in 2020 forced customers to rely on technology for a wider range of financial transactions, including ones that required higher levels of trust, like loan or mortgage applications and large payments.”

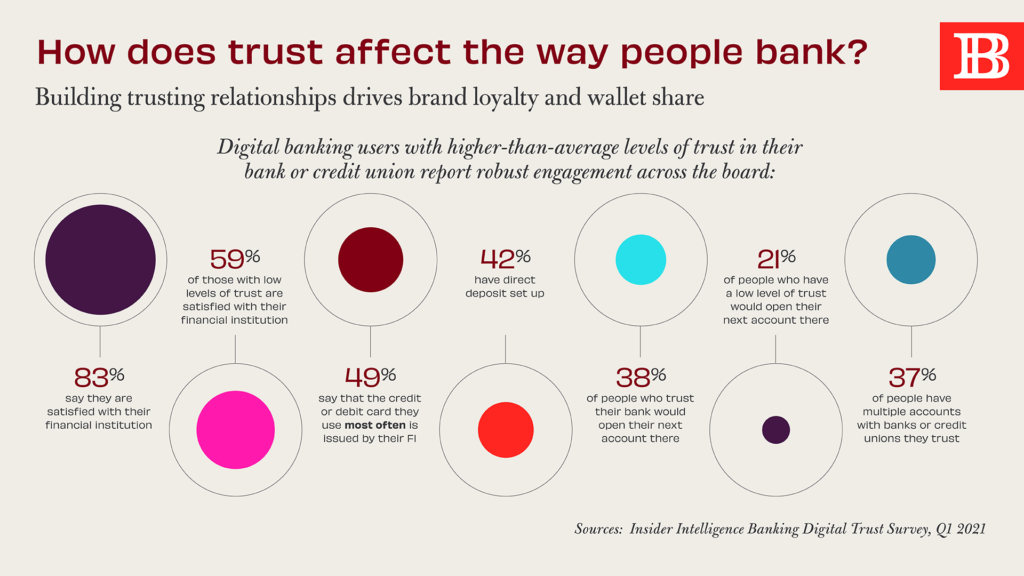

Now that we’re resuming our regular routines, what does trust look like in post-COVID banking? Having a primarily financial relationship is one benchmark for consumer trust. “Primary financial institutions hold a valuable competitive edge over banking challengers in terms of consumer trust,” according to Insider Intelligence’s Banking Digital Trust study, which surveyed U.S.-based digital banking users in Q1 2021. “The largest proportion (48.0%) of respondents cited their primary FI as the company they’d trust most to provide them with financial services – up from 42.5% last year – when now second place PayPal reigned as the most-trusted provider.”

According to Morning Consult, banks and credit unions are the fortunate beneficiaries of some cultural affinity. “Banks and credit unions are the most trusted financial institution, with 61% of consumers saying they ‘naturally’ trust banks,” according to ABA Banking Journal’s reporting on the financial services survey. “By comparison, 51% tend to trust insurers, 48% tend to trust payment companies and 36% tend to trust investment and wealth management providers.” Going even further, banking has a leg up on challengers coming into the banking space, namely fintechs. A Bank for International Settlements (BIS) survey on trust finds that “Americans trust traditional banks more than government agencies or fintechs – and far more than Big Tech – to safeguard their personal data…”

Trust goes deeper than transactions, though. Safe and secure banking – digitally and otherwise – is table stakes to be sure. But building a trusting relationship necessarily and naturally means more. As Forbes contributor, Hendrikse says, “Purpose underpins public trust… Everything else [beyond transactions] a bank stands for is becoming equally important to consumers – just as it is for other brands across industries.” Outlined in the Future of Banking Is Built on Trust report, banking’s biggest asset is their level of inherent consumer trust and Forrester urges banks and credit unions to not squander it. The research firm says, “Trust sets banks apart from almost all other platforms. But they must use it wisely to drive value into every engagement… and to deepen collaboration.”

Stay tuned as Believe in Banking continues to provide insights on the best ways for banking to build trust and tap into the power of purpose for their organizations.