A roundup of recent M&A bank deals and how FIs can respond to consumer demands for better banking experiences

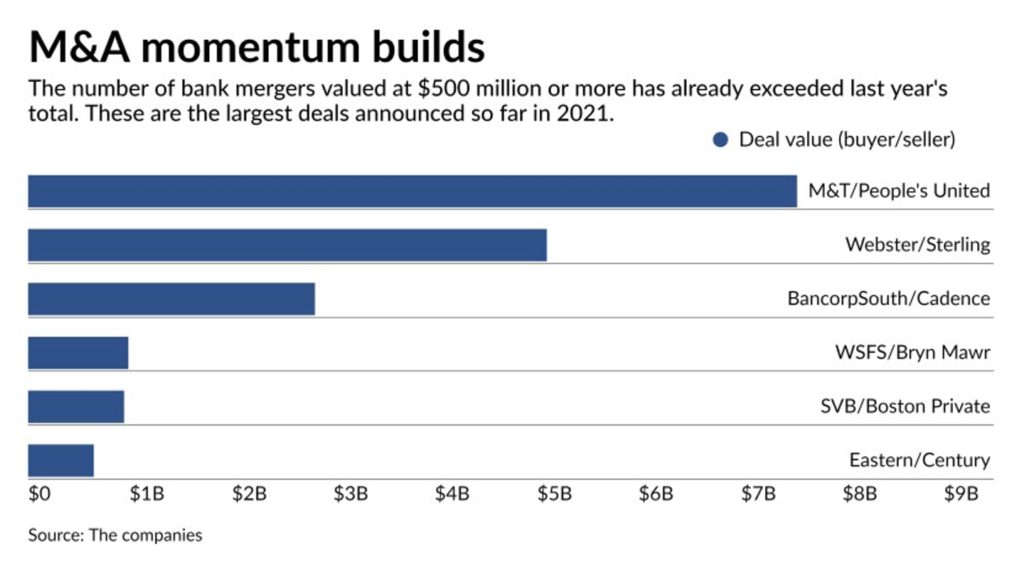

With concerns over credit losses receding and the economy stabilizing, financial institutions are renewing their interest in mergers and acquisition deals. American Banker reports that banking resiliency is also playing a role in M&A activity, saying, “A steady rise in bank stock prices in recent months has put potential buyers in a stronger position to pursue acquisitions.” New mergers announced in the last ten days of April 2021 include the all-stock deal between BancorpSouth and Cadence Bank, creating a regional powerhouse, and the $5.1 billion dollar deal for Webster Financial’s purchase of Sterling Bancorp, news that sent values of both companies rising.

This recent merger movement marks “the latest in a spate of regional bank mergers that analysts say will likely continue amid low-interest rates and a push to scale in an increasingly digital world,” according to Forbes. As mid-size banks leverage a recovering post-pandemic economy, federal regulators are taking a closer look at these deals, too. While consolidation may spur additional DC scrutiny, the practical reality is that “These deals often make financial sense, “according to Reuters. “Bancorp and Flagstar are among the medium-sized firms that have struggled in the near-zero interest rate environment. The combined company, with $87 billion in assets, would help them better compete against giants like JPMorgan (JPM.N) or fintech upstarts.” In other words: scale to survive.

As institutions focus on financials for their future, it’s also critical for banks to respond to consumer demand as they scale, especially in the branch environment. Post pandemic, 75% of consumers are looking for better banking experiences from their primary financial institutions. That’s a fact not lost on banks and credit unions as 97% of FIs are planning on addressing branches in the next two years. Using the merger as an opportunity to redesign and reimagine the branch experience, these merged institutions will be in a better position to further leverage their network of branches and meet consumer expectations at the same time.