Principles and practices for championing purpose within financial services

As financial institutions unlock the many benefits of building trust with consumers – especially through Covid, and as we move into a post-pandemic recovery – one key method is to champion purpose in their relationship-building. This can mean different things to different institutions, but one thing is clear: The pandemic has shifted consumer priorities toward brands with strong values, with 60% needing to believe in what a brand stands for before buying. Making the path to purpose even more urgent, one out of every ten U.S. consumers is considering switching their primary financial institutions in 2021.

In the wake of COVID, financial institutions from large to small are reevaluating the way they live out their values and embrace purpose in everything they do. From diversity to sustainability, aligning institutional actions with deeper brand values is non-negotiable. According to the Financial Brand: “Financial institutions can no longer concentrate solely on helping customers make smart financial decisions. Competition from online providers is growing and consumers’ expectations are rising. More consumers than ever now want to bank with organizations that operate with the highest integrity and treat employees and the environment well.”

Beyond the table stakes work of living out institutional mission, vision, and values, how are banks and credit unions meaning more – and building more loyal, sticky relationships along the way? We’ve rounded up five of the best practices for building more meaning into banking.

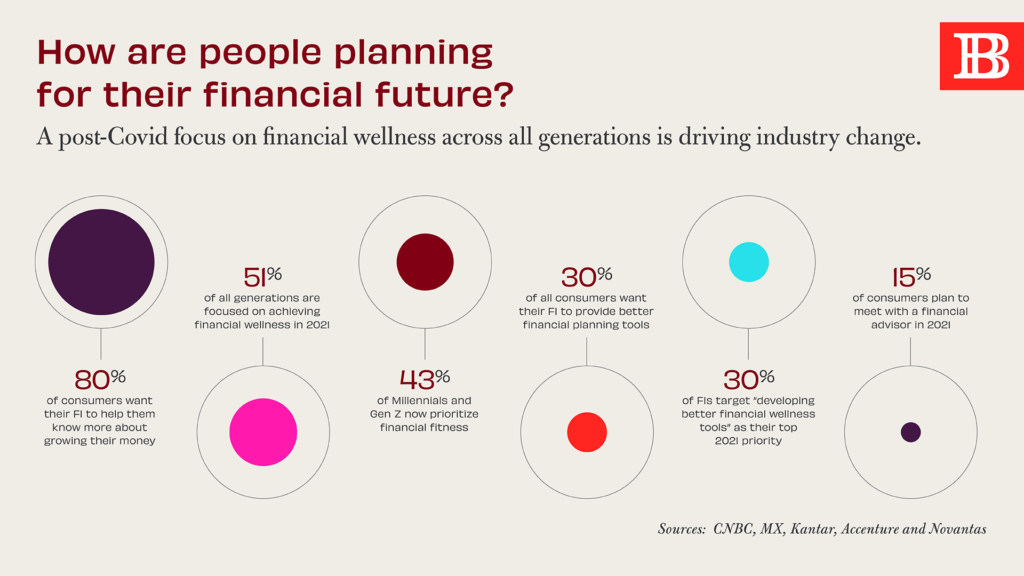

1. Financial Wellness at the Forefront

In our recent spotlight on Discovery Bank in South Africa, we showed how a post-pandemic focus on financial wellness for customers is a way to meaningfully infuse purpose into a bank’s business. With behavioral economics at the core, Discovery Bank’s approach centers individuals doing better financially, which in turn results in the economy at large thriving. By tracking people’s financial behavior and incentivizing them to make better decisions, the bank has powerfully activated consumer data. More than a rewards program, this “holistic, dynamic approach exemplifies a purpose-driven model, with a goal having a far-reaching, positive societal impact.”

As consumer focus has shifted decisively toward building financial fitness – and as FIs prioritize building better tools to empower people to budget, reach goals, and plan ahead – banks and credit unions have an opportunity to shift the narrative of their role in people’s lives through messaging and campaigns that support financial literacy and making sound choices.

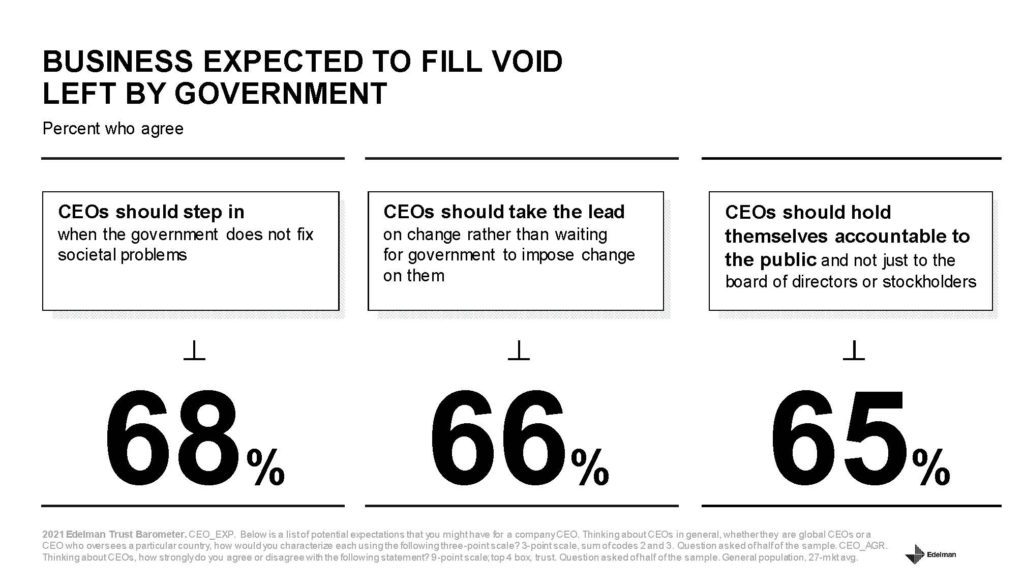

2. Stand Up for Social Good

As consumers make it clear they’re seeking out relationships with purpose-driven brands in general, banks and credit unions should stand up as an institution that stands for good. Data from Edelman’s Trust Barometer reaffirms this role, with 66% of consumers expecting business to fill the void left by the government. Whether it issues within an institution’s direct control or not, consumers think brands they do business with need to play an active part in improving society. Beyond internal diversity and sustainability initiatives, banks and credit unions must make their position on issues upfront and part of their approach to the whole of their business in order to build trusting relationships with consumers.

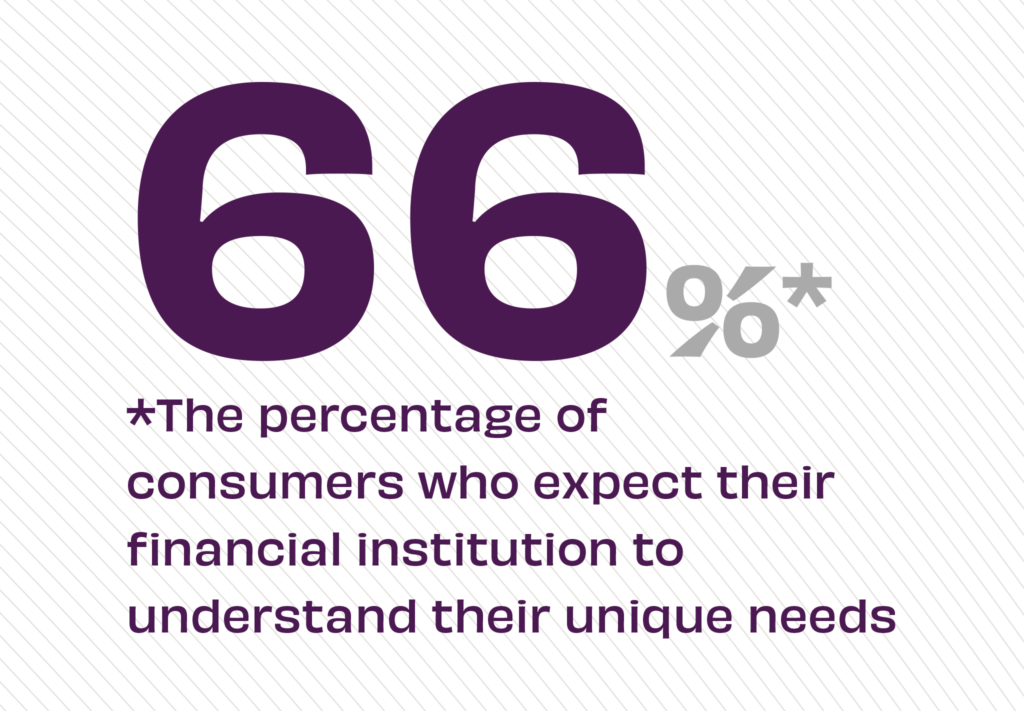

3. Customer-Centricity at the Core

While COVID has served as a catalyst for many changes in the consumer landscape, one area that has real staying power is the role of customer-centricity in banking. Putting the customer at the center of all of an institution’s decision-making empowers banks and credit unions to make meaningful personal experiences for consumers that ensure they feel valued in all of their interactions. Powerful connected data is key to centering the customer, empowering FIs to personalize experiences across every consumer channel. Or as Adrenaline’s head of strategy Juliet D’Ambrosio says, it “builds a bridge for audiences between digital engagement and in-person branch interactions.”

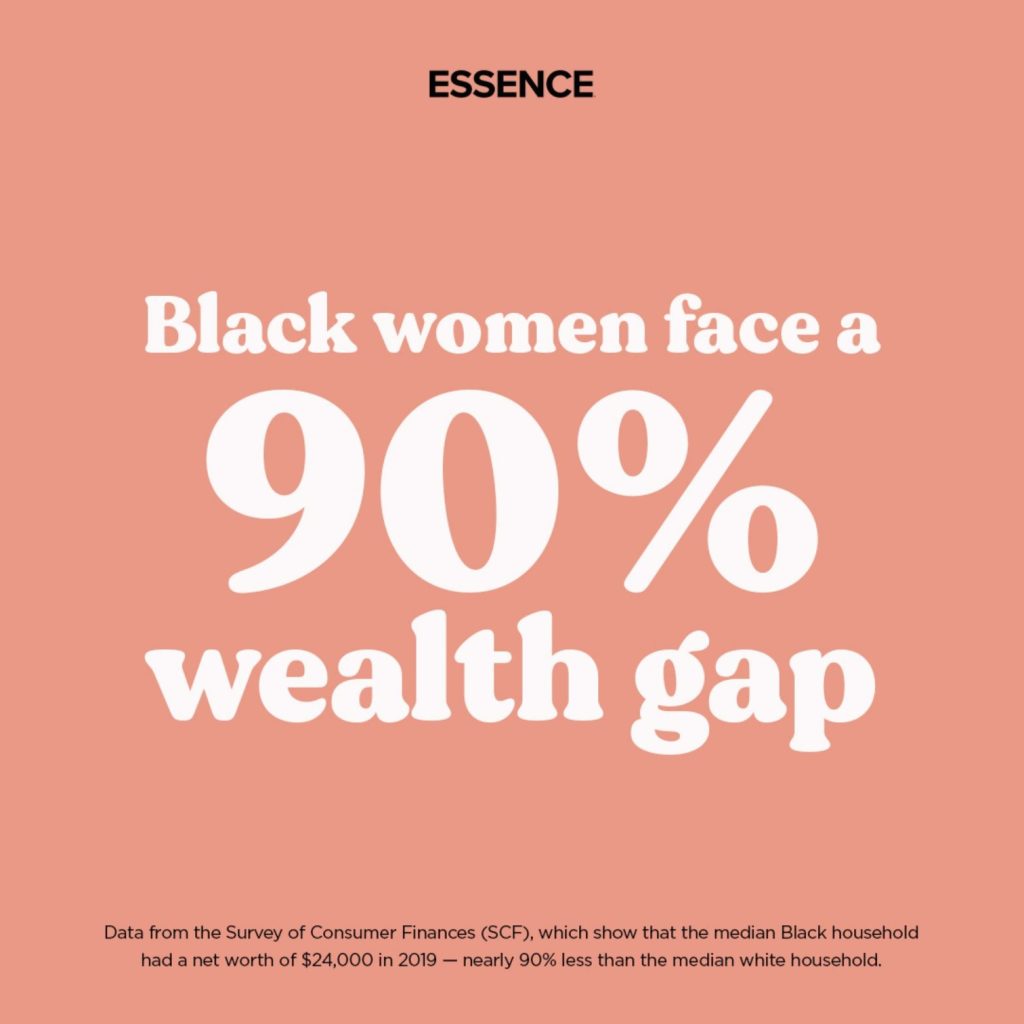

4. Foster a Heart for Service

Whether it’s a focus on serving underbanked communities or addressing the unequal impacts of COVID, banking has an opportunity to show its essentiality now more than ever. Banks can deepen trust with diverse communities by following through on their commitments after the Black Lives Matter (BLM) protests and demonstrating that they’re doing more than merely responding to consumer demand for banking to do better. As we outlined in Increasing Investments: “What needs to happen next is that these efforts must be accelerated and engrained in the way financial institutions do business and grow their influence,” driving meaningful change from within at the institutional level.

5. Leverage Local Influence

Where purpose really comes home is right at home. As Sean Keathley and Gina Bleedorn outlined in their most recent podcast, the real value of community institutions is trust-building that happens at the local level. Financial institutions are delivering experiences for consumers at the branch and that’s exactly what data shows consumers want, with 92% of them reporting they will only open an account with a bank that has a branch nearby. More than transactions and consultation, though, deepening investments at the neighborhood level and communicating their local value helps banks and credit unions demonstrate they’re part of the fabric of the local community and they’re there to stay.

For more insights on the power of purpose, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services and informing the banking experience. To develop meaningful experiences for customers and members, contact Adrenaline’s experts at info@adrenalinex.com.