How humanized technology achieves experience for the consumer and efficiency for the bank

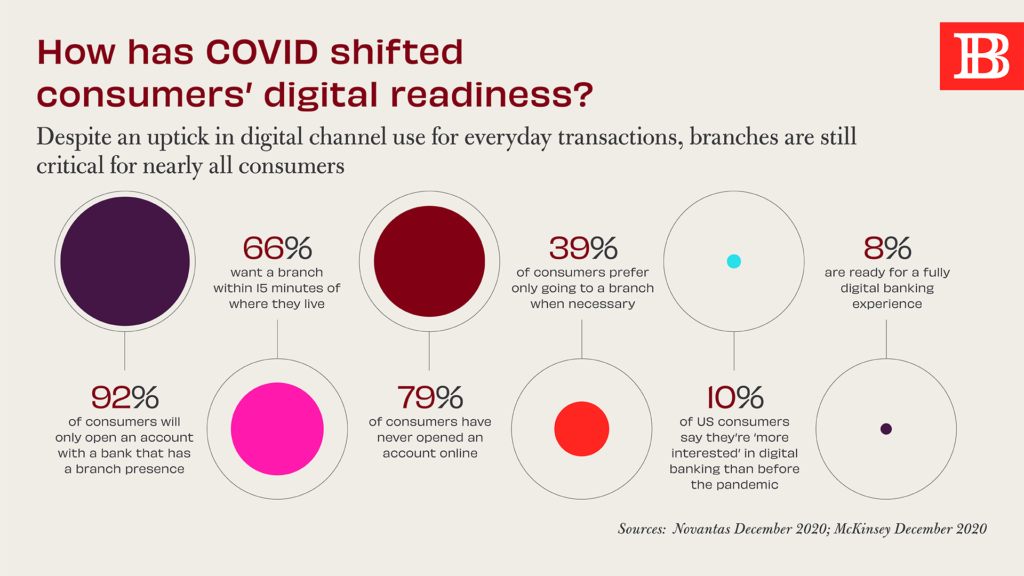

In the Rise of Remote, we explored consumer requirements, especially during COVID, for safe, socially distant and self-directed banking and how ITM deployment was perfectly poised to meet this customer and member demand. Now that we’re beginning to see the light at the end of the COVID tunnel, will the consumer desire for remote access simply recede as people return to the branch? Not so fast.

Data prior to the pandemic demonstrated consumer behavior moving towards opt-in mobile and remote delivery banking; COVID just sped it up. Further, ITM deployment does more than meet consumer demand; it advances efficient banking experiences – just like the ATM that came before it – which delivers benefits for the consumer and the financial institution, alike.

Self-Directed Banking

Decades ago when the ATM was first introduced, a new era in self-service banking was born. Just as other industries were introducing self-service in the 1950s and 1960s – like fueling at gas stations and ticketing at bus terminals – the ATM was deployed in urban centers in Europe and Japan. The introduction was to such little fanfare, it’s hard to pinpoint the exact location of the first one with competing histories claiming it as their own. “In spite of their cultural significance, ATMs recede into the noise of everyday memory,” according to A Brief History of the ATM. “Few stop to reflect on how they – and the computer infrastructure that supports them – became the backbone of contemporary retail payments.”

The ATM and its backend infrastructure forever altered our concepts of consumer convenience in both banking and buying. Available to serve customers throughout a bank’s footprint, the ATM has become such an ingrained part of our banking experience, it set the stage for subsequent technologies and touchpoints like mobile banking and today, ITMs. Self-service is taken even further with ITMs providing a human + technology hybrid available right around the corner. Beyond transactions, ITMs have a live support component where customers and members can interact and get financial advice, open accounts and more, especially when deployed in a secure environment.

Efficiency for Banking

For the bank, ITMs provide a bridge for digital and physical channels and dot-connect between other branch-based channels. Costing significantly less to deploy than even a micro-branch, the ITM can service many consumer banking needs and provide local market presence for the institution, something that consumers consistently report remains important in choosing a primary financial relationship. One additional benefit that ITMs have over ATMs deployed decades before them is that consumers are already familiar with using a machine to deposit checks and get cash. That means the consumer adoption curve for ITMs will not be nearly as steep as it was with ATMs, which took until the 1980s to achieve widespread acceptance.

As banks plan for migration – looking at what’s coming out of the branch and where it’s going – ITMs can provide a critical link for consumers as the branch channel contracts. Meeting post-COVID demands, most financial institutions report that enhancing experiences is a top-priority, even as they prize efficient delivery. With the additional functionality over the ATM – namely the live human component – the ITM can be a way to further personalize the banking experience, something consumers increasingly expect from brands, especially post-COVID. A detethered drive-up ITM can also help banks recalibrate and optimize the drive-up experience, while offloading up to 75% of transactions from the branch.

Remote Delivery

During and post-COVID, the drive-up window has been a lifeline for banking service continuity. Once a forgotten holdover, the drive-up window or motor bank has taken on new relevance through the pandemic. Its remote delivery model has made consumers feel safe, but served at the same time. ITMs provide that same level of personalized, human-centric service, but with a much more flexible staffing model and at much lower cost, especially once they’re detethered from the branch. More human than ATMs, remote ITMs can deliver on demand for the branch even as consumers move more digital in their transactions.

The pandemic provided the perfect test case for ITMs for banks fortunate enough to have them as part of their network. Guaranty Bank & Trust saw immediate benefit to their ITM deployed as part of a larger bank renovation. The bank realized efficiencies in staffing by managing the ITM remotely at the same time they offered extended hours to customers. Hue Townsend, GB&T’s President & CEO says, “Being one of the first banks in the MS Delta to be able to offer this cutting-edge technology using an ITM, we have the functionality of the branch using standalone ITMs, creating an opportunity to attract more customers and provide flexibility to our existing ones.”

For more insights remote delivery and ITM deployment, stay tuned to Believe in Banking as it tracks the big trends that are impacting financial services and informing the banking experience. To develop meaningful experiences for customers and members, especially in the wake of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903.