How banks are using AI to unlock revenue opportunities and revolutionize customer experience

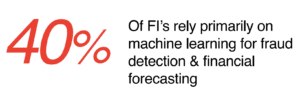

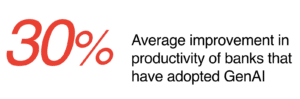

The big buzz in banking is all about artificial intelligence (AI), specifically generative AI (GenAI). This technology takes machine learning to the next level, especially for translating data into actionable insights and transforming manual processes like data entry into efficient operations. While no one can deny the promise of this game-changing technology, where financial institutions are struggling with AI is not in defining what it is, but how to employ it to best benefit their banks. “To date, most AI use cases in banking have aimed to either automate tasks or generate predictions,” according to S&P’s analysis, noting AI’s use in risk analysis, financial forecasting and fraud detection.

For their part, banking leaders are sure of GenAI’s power. “Two-thirds of senior digital and analytics leaders attending a forum on GenAI said they believed the technology will fundamentally change the way they do business,” according to McKinsey’s exploration of GenAI in banking. While there is little doubt that AI will be transformative, the path forward is less clear. “There is absolutely as much opportunity here as there could be risk of negative change,” says Gina Bleedorn, president & CEO of Adrenaline, on the Believe in Banking Podcast. “Really, the only choice is to embrace AI and figure out how it can help [banks] move ahead, capitalizing on the opportunity it could afford.”

One way banks are making strides is by deploying GenAI through their existing tools, like Bank of America is doing by incorporating search into its virtual assistant Erica. Aside from advances in chatbot functionality, data seems to be the next new frontier for banking AI. “Financial services firms know they’re sitting on petabytes of financial data that could create revenue opportunities if only they could process it,” according to BAI’s article on use cases for AI in banking. “Generative AI can help analyze, clean, and organize complex datasets, which is an important first step because many of the other potential AI applications require high quality data to deliver meaningful results.”

The activated data can help banks and credit unions drive more meaningful experiences by personalizing offers for prospects. “The key for financial institutions will be to create a clear plan throughout the customer lifecycle,” says James Robert Lay, CEO of banking consultancy Digital Growth Institute, in the Financial Brand. But data doesn’t all have to be clean and structured to be useful. “Gen AI’s natural language capabilities can extract insights from unstructured data like historical service interactions, social posts… and provide frontline bank employees with prompts to enhance their engagement with customers,” according to BAI. “The strategic deployment of tailored AI solutions enables financial institutions to profoundly improve the overall customer experience.”

If you’re a banking leader looking at serving more and serving better, get in touch with the banking and credit union experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.