The Story:

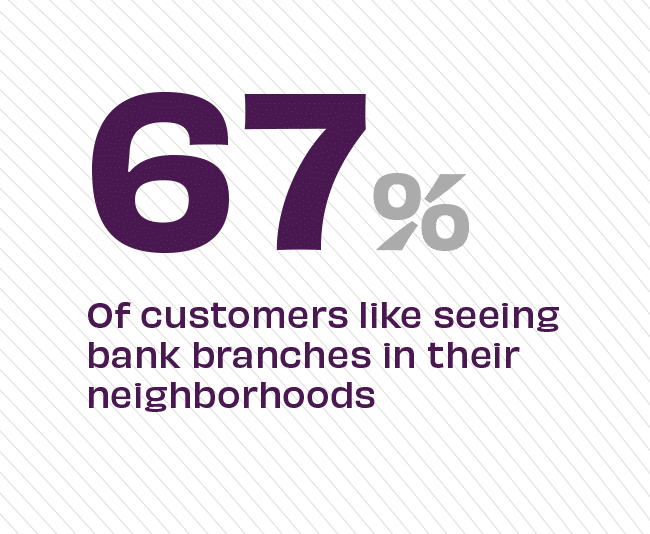

Across all age demographics and geographic locations, people still value the branch and want them in their neighborhoods, so that they feel connected and protected. Though digital channels are convenient – and necessary – they don’t help build personal connections that are key for banking relationships. In fact, 71% of customers in the United States turn to branches to solve specific and complicated problems – seeking out solutions for new and ever-changing economic challenges.

The Takeaway:

Though many banks and credit unions may see lower overall foot traffic as a reason to pivot away from branches, the reality is that banks with more branch density are more profitable and stable. Despite their efficiency, digital tools alone fail to provide customers with human expertise and support. By leveraging the bank branch for consultations with customers, financial institutions can provide more comprehensive – and profitable – solutions for their customers, boosting revenue up to 20% from primary customers.

Source: Accenture, “Reignite Human Connections to Discover Hidden Value,” April, 2023