The Story:

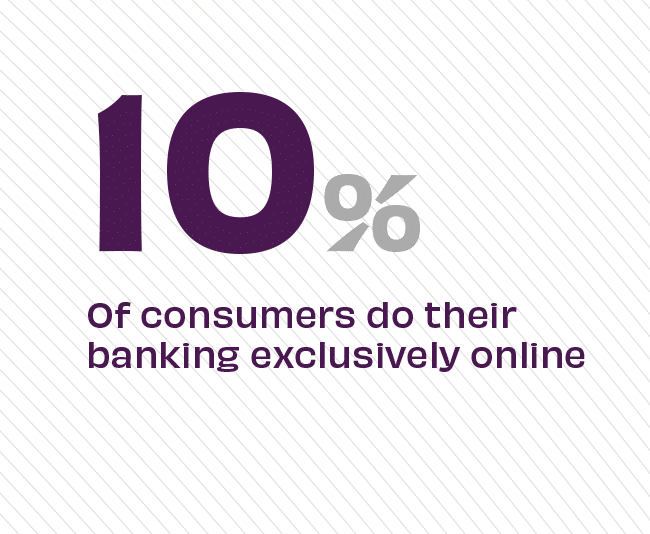

New data shows that despite the rise in digital channels, nine out of ten consumers continue to use a mix of in-person, online and mobile tools for their banking needs. During the pandemic, people assumed that customers would inevitably move to digital banking channels exclusively. But what we’re seeing instead is that customers who only use the branch (3%) or only use online channels (10%) are two bookends of a spectrum, with the vast majority of customers somewhere in the middle. Even more, age demographics don’t determine channel preference. Gen Z, for example, is not “all TikTok and texting,” and Millennials, surprisingly, represent the highest users of in-branches services among all generations.

The Takeaway:

It goes without saying that banks and credit unions need a strong customer base that spans all age demographics, forging relationships with people early and keeping them as lifelong customers. Meeting people where they are – whether that’s online or at the branch – is essential to delivering the right experience at the right time. “The pandemic has pointed consumers back toward the branches and put pressure on institutions to offer service that is both high-tech and high-touch,” says Juliet D’Ambrosio in Smarter Branching for Growth. She finds ultimately what consumers want is “both/and: efficient transactions and valuable advice at the point of need.”

Source: Vericast, “Anatomy of a Banking Customer,” 2023