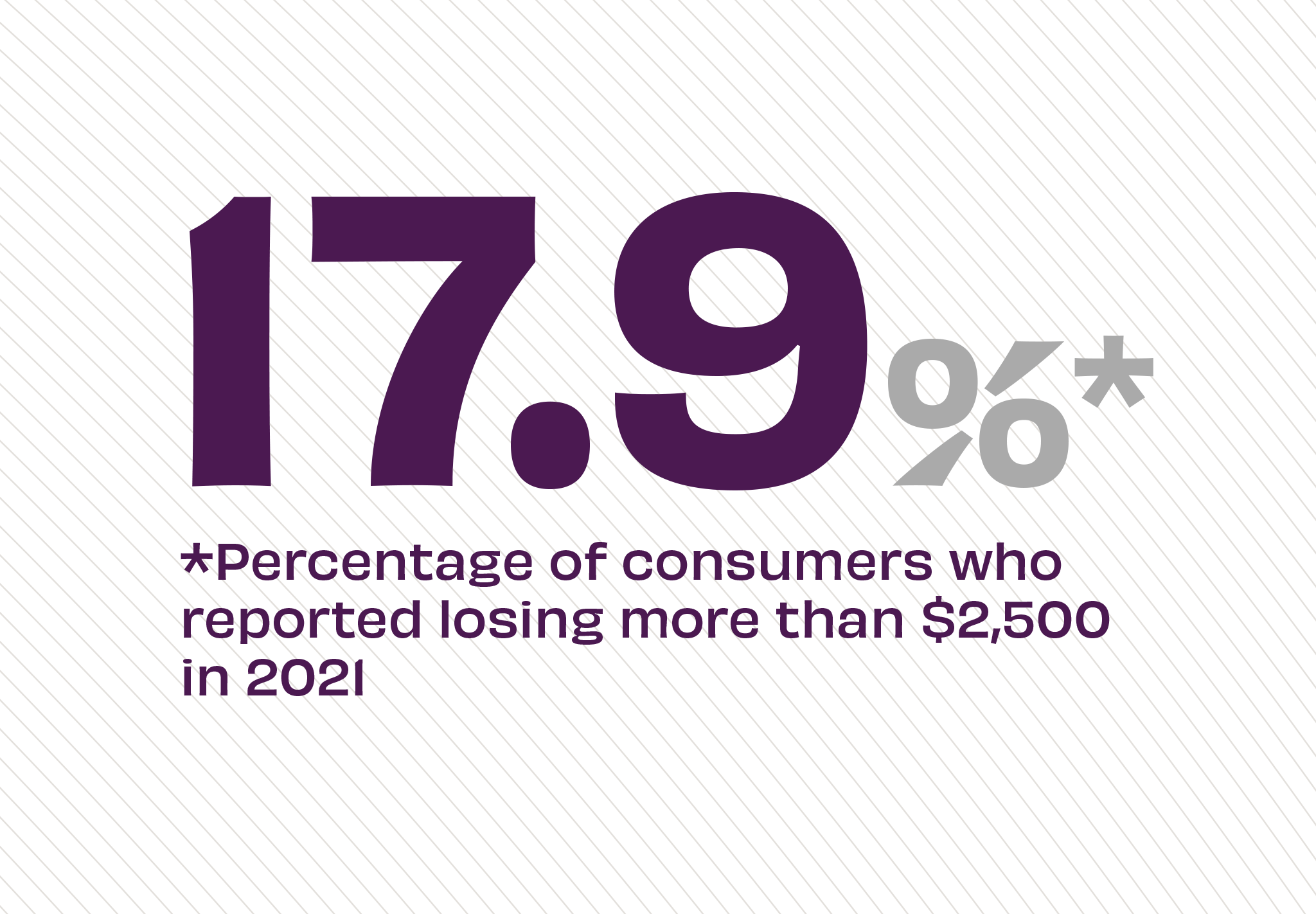

The Story: A recent survey by the Financial Educators Council asked consumers how much money they estimate losing because of a lack of financial education and expertise. At $2,500 for nearly 1/5 of consumers, last year represented a high watermark, nearly doubling the previous annual estimate and translating into a cost of $352 billion economywide in 2021. Going even further, altogether consumers estimate they’ve lost an average of $9,275 over the course of their lifetime because of high fees, non-competitive interest rates and investment losses.

The Takeaway: If public sentiment points toward a belief that the financial system benefits those with financial know-how and disadvantages those without, the clear solution is to help average consumers compete in the knowledge economy. By supporting and empowering people with financial education and customized consultation, they’ll be in a position to make better financial choices throughout all of their life stages. For institutions, prioritizing financial literacy means delivering on a customer-centric approach that will result in deeper and more long-lasting relationships.

Source: National Financial Educators Council, “Financial Illiteracy Cost Americans,” January, 2022