The Story:

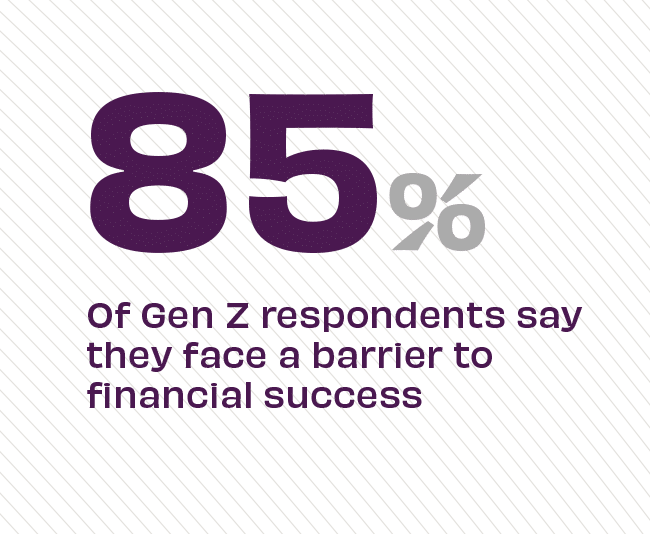

Data from Bank of America finds that Gen Z is focused on the future, planning now for how they’ll achieve their long-term financial goals. They report obstacles to their success, including the high cost of living (59%), insufficient income (45%) and housing prices (31%). However, they’re combatting these external forces by switching to higher paying jobs, taking on second jobs and making their passion projects more profitable. Ultimately, Gen Z is taking an informed and proactive approach to their financial situation.

The Takeaway:

To connect with Gen Z customers, banks and credit unions are prioritizing financial education and consulting services both in-person – in branches and other classroom-type settings – and online – in digital platforms such as webinars, social media content, and video tutorials. “Gen Z is ready to learn,” says Christine Channels, Head of Community Banking and Consumer Governance at Bank of America in an interview with The Financial Brand. “Dialogue with these younger customers can be a building block of a long-term, loyal bank customer.”

Source: Bank of America, “Better Money Habits” Survey, and The Financial Brand, “Gen Z’s Changing Financial Profile,” September, 2022