How banks and credit unions are leveraging their expertise to empower consumers

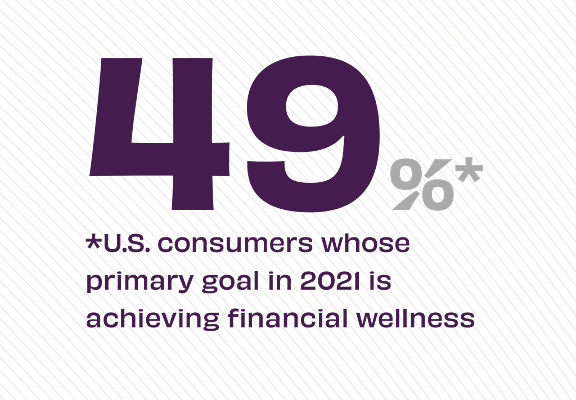

As the U.S. marks the anniversary of COVID shutdowns with renewed hope via vaccinations and a recovering economy, financial services providers like banks and credit unions are redefining how they deliver consumer value, and in turn, reawakening their own set of purpose-driven values. “While health concerns may be alleviated by vaccines and controls, consumers face an economy with an uneven recovery shaping up,” according to the Financial Brand. “[B]ut banks and credit unions can provide tools to help.” Not only can banking provide tools to help, consumers want them to as nearly half of them focus on their financial wellness in 2021.

While about one-third of financial institutions report developing better financial tools as a top priority in 2021, how are they delivering on consumer demand? KeyBank boasts an entire Financial Wellness Center platform with information on topics ranging from debt and credit to saving and budgeting. Not satisfied with educational articles alone, the Ohio-based bank provides interactive tools like a three-minute plan and a money quiz, and leans on the deep expertise of its bankers in its financial wellness review. The bank has created a user-friendly platform that’s both practical and actionable. “It’s about knowing where you stand and having a plan to get where you’re going,” according to KeyBank. “Less about skipping lattes, more about taking small steps that keep you moving in the right direction.”

Financial services leader JP Morgan Chase has a purpose-driven approach to the topic leaning in heavily on thought leadership and deep financial services expertise. With a multipronged model, the banking giant is leaning on investments in technology to meet the needs of the next generation, including the Financial Solutions Lab to “to cultivate, support and scale innovative ideas,” and the Catalyst Fund, a fintech accelerator for better financial budgeting, planning and spending habits. On the retail banking front, Chase still leans heavily into productized solutions for consumers like automatic savings and rewards programs – which sometimes inadvertently incentivize spending over saving – and still prioritizes their popular free credit score program for customers to stay on top of their finances.

So critical is the need for financial literacy, leaders from other sectors are now getting involved. Using April’s annual Financial Literacy Month as a jumping off point, legislators and educators are again picking up the mantle of financial education in schools. Currently only 21 states require a personal finance course to graduate and of those, none are required to meet a national standard. On the heels of a pandemic that roiled the economy, leaders and legislators are proposing to do more. “Kids come out of school having no clue about financial literacy,” according to Ohio State Senator Steve Wilson, a former banking executive who is co-sponsoring a bill in the state. Without basic tenets of financial literacy, “You go out into the world greatly disadvantaged.”

While everyone from the Better Business Bureau to financial planners seem to be responding to the consumer appetite for financial wellness, banking has a unique value proposition and position. As consumers look to simplify their financial lives by pulling all their accounts together, local banks and credit unions will be the first place people look to for positive experiences and rewarding relationships from brands they can trust. If banks and credit unions don’t focus their financial wellness initiatives on products and services – that get more out of consumers in the form of rates and fees – and instead concentrate their efforts on delivering real value grounded in their own institutional values, their payoff will be lasting long-term relationships that are rich, rooted and robust.