The Story:

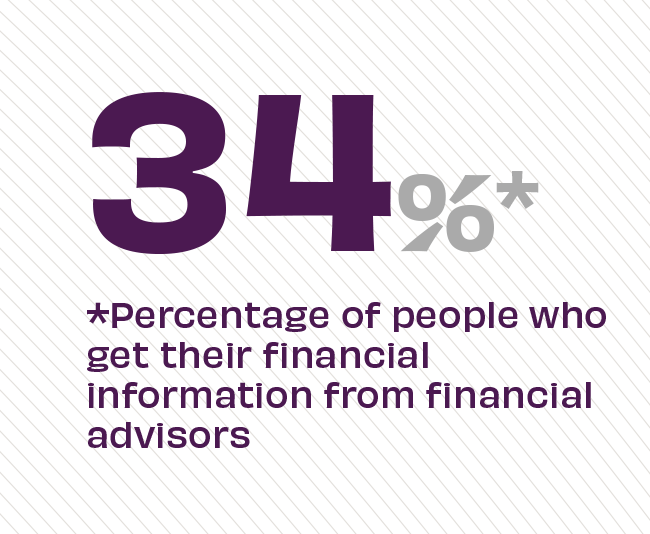

According to robust research from FNBO in their 2022 Financial Wellness Survey, just one-third of consumers tap financial experts like bankers for their saving and spending questions. Instead, when looking for financial advice, large numbers of people are going to websites (76%), and social media (41%), with those under age 30 using YouTube, TikTok and Facebook as their primary social sources. This data comes at a time when consumers are increasingly seeking to improve their financial wellness and increase their savings.

The Takeaway:

Consumers often seek out financial advice online because of the convenience, and because financial concepts are explained in compelling and fun ways. However, traditional FIs are still the most widely trusted source of financial information. “While it has been encouraging to see increased consumer interest in investing, saving and finances,” says Sean Baker, executive vice president with FNBO, “The numbers from our survey demonstrate the extent to which knowledge and proper guidance all play an invaluable role in helping to build a smart financial future.” To bring more customers into the fold, FIs should join the conversation online and on social media, producing video content and leveraging influencers to maximize their impact.

Sources: FNBO, “FNBO Releases Data from 2022 ‘Financial Wellness’ Survey,” March, 2022