Upbeat consumer sentiment and key economic indicators show rebounding economy just in time for the holiday season

With the approaching holiday season, consumer confidence in the economy is on the rise, gaining four points in October alone. According to Christopher Rupkey, chief economist at FWDBONDS in Reuters: “Consumers are more upbeat… and this argues for a strong finish for the economy in 2021.” Bankrate’s analysis finds that despite supply chain disruptions several signs point to growth. “[T]he financial system has made significant progress at rebounding from the coronavirus pandemic-induced plunge. Not only that, but the U.S. economy by sheer size is bigger today than before the outbreak, with economists expecting the fastest rate of growth in decades – a clear green light for the financial system.”

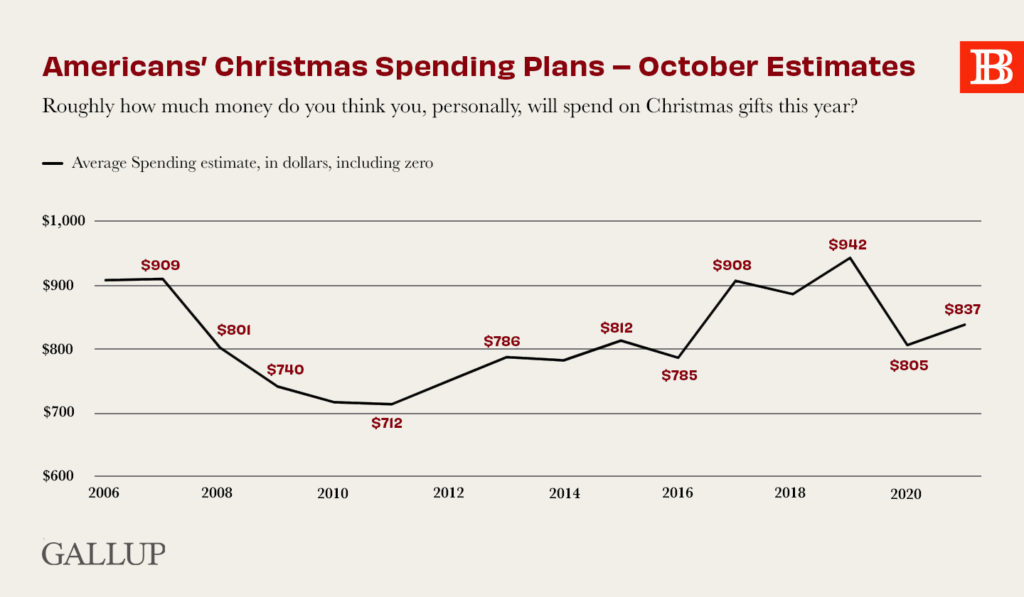

But will consumer optimism result in more robust spending in the retail sector? Gallup’s holiday spending forecast predicts a small, steady increase after a significant pandemic decline in 2020. “Gallup’s measure asking Americans to estimate their total spending on Christmas gifts has been a good harbinger of holiday retail sales in most years,” The October report generally “sets the baseline for where things are headed” in the economy. Even in the midst of an enduring pandemic, “it appears consumers are gearing up to spend enough to give retailers an average, if not great, holiday season.”

With banking largely exceeding expectations in Q3 earnings, the financial services sector is also poised for progress and set to support expanding business commerce in the wake of an economic rebound. In particular, an expansion of business lending would herald even better news for overall economic health in the U.S. “If regional banks show signs of accelerating loan growth, it could signal an easing of supply chain bottlenecks that have weighed down the U.S. economic recovery from the pandemic,” according to reporting on healthier supply chains. Dave Ellison, portfolio manager at Hennessy Funds, says, “Increasing demands for new loans at higher interest rates could signal that small businesses are securing inventory and expanding.”

How will consumer sentiment help financial services, specifically? In Rising Consumer Confidence Is Good for Banks, Motley Fool says “higher consumer confidence should translate into higher loan demand” which is good for banking’s bottom line. “And when consumers feel more confident, they tend to spend more.” Certainly, that cashflow is good for the overall economy, but it’s even better for financial institutions. “[B]ecause banks generate revenue from fees every time a consumer uses a debit or credit card, higher consumer spending almost necessarily translates into higher revenue for banks.” With business lending products and payment services like Zelle at the ready, banks really should be in the holiday spirit.