The Story:

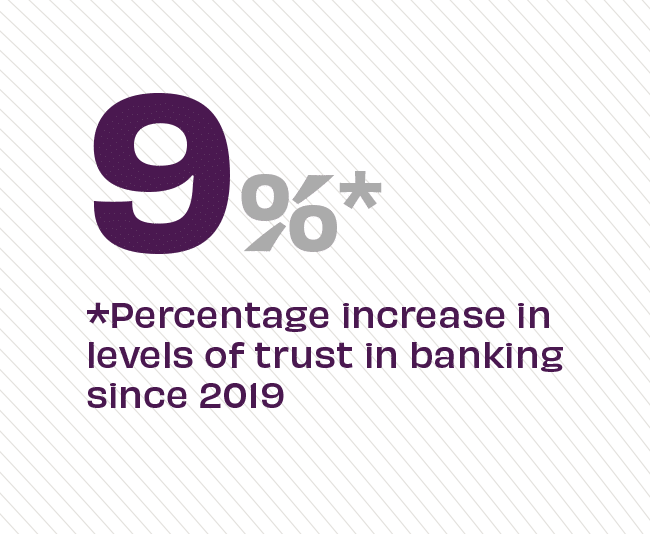

New data finds that despite recent challenges in the sector, overall faith in banking is up nine percentage points over the last four years and remains high among all age demographics, but most notably among prime banking targets of Gen Y and Gen Z. “Their view of the banking sector is not shaped to the same extent by the past,” finds Ipsos addressing generational views of previous financial crises. “Instead they are interested in the positive impact banking can have moving forwards – both on their lives and on society more broadly.” Improvements in core values are credited with this improvement, including the perception that banking is not only good at what it does, but that it is well-led and behaves responsibly.

The Takeaway:

The data gathered just days following the failure of Silicon Valley Bank and others shows the stability of the banking sector. “Americans’ banking behaviors are largely unchanged – they are not withdrawing large amounts of cash or questioning their institutions,” says Juliet D’Ambrosio, Adrenaline’s Chief Brand Officer, in the most recent episode of the Believe in Banking Podcast. In fact, we’re seeing the opposite phenomenon happen, where 65% of millennials report being more interested in local financial institutions, ones that have sound practices, that are invested in their community.” These findings underscore the importance of banks to demonstrate their purpose and show the good they do in their community.

Source: Ipsos Global Trustworthiness Monitor, “Growing Trust In Financial Services,” April, 2023 and