The latest information and insights on how financial institutions are making the most of engagement and experiences at the branch

Since the release of the smart phone in the early 2000s, people have predicted the death of brick and mortar – from the retail store to the bank branch. While the digital age has undoubtedly upended the majority of consumer-facing industries, banking still has a particular role in people’s lives, and it’s one steeped in trusting relationships. For banks, closing too many of their branches comes at a cost. “Reducing the geographic footprint and encouraging customers to use only the bank’s digital channels has had obvious benefits,” reports Insider Intelligence on the role of branch. “But the cost savings from branch closures have come at the expense of personal relationships.”

In fact, new data from the National Bureau of Economic Research finds that when nervous customers began moving their money following the spring’s regional banking crisis, deposit outflows were the largest among banks with the smallest branch networks. The takeaway is that banks that prioritize face-to-face interaction at the branch perform better, in the short and long term. “If you invested less in branches and more in websites in the past few years, you were able to get a lot of deposits cheaply, says Matt Levine, former investment banker at Goldman Sachs, in his Bloomberg Op-Ed. “But in the spring of 2023, you weren’t able to keep them, because nobody was shaking hands with your website.”

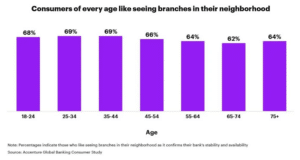

To assess consumer sentiment about their banks, Accenture spearheaded one the financial industry’s largest initiatives – surveying nearly 50,000 bank customers across the globe. What they found was not a great digital migration. Instead, they discovered that two out of three people regardless of generation want bank branches in their neighborhoods, especially for essential functions, like opening accounts and getting advice. In tough times, branch presence is even more important. “In a crisis, people crave familiarity and certainty,” according to Forbes’ exploration of branch banking. “A bank branch is an important way of making a bank feel permanent and real and acts as a constant reminder of the brand and the ability to have a relationship beyond just a screen.”

How banks deepen relationships is by rethinking branch purpose and reorienting their branches toward an evolving North Star. These experiences are typically centered less around the transaction and more around the interaction. “A branch experience in which customers can walk in and have a casual conversation with an employee gives banks the opportunity to understand the customer’s financial goals and act as a trusted financial advisor – not just a provider,” according to Insider Intelligence article on revamping branches. “Now that banks and credit unions are getting by with fewer branches, it’s increasingly important for them to rethink their existing networks.”

Since all branches aren’t created equally, it’s time for banks to do more than make a binary decision to open or close their retail locations based on opportunity. With the stakes this high, bank and credit unions need to look at building rightsized and resilient branch networks. “The best way to be resilient is actually to start with what you already have,” said Gina Bleedorn in her recent presentation at Future Branches in Boston. “This is a step so many banks don’t take – which is akin to market research or analytics – but it’s an assessment of your own branch network.” This will help financial institutions make the most of their current network, even as they expand to new markets.

Inside the branch, the design should achieve a balance of form and function based on what consumers want. That may mean providing a gathering place like the still popular branch cafés or prioritizing proximity through efficient formats. But rest assured, the bank of the future is not entirely branchless. “Younger consumers are more willing than older consumers to meet a bank’s financial advisor at the bank branch to discuss their financial future,” according to the Insider Intelligence article on consumer attitudes toward branches. “Brick-and-mortar establishments symbolize stability and a commitment to customer accessibility – an impression that spans across all age groups and all geographies. A branch suggests that a bank expects deposits to stick around.”

If you’re a banking leader looking for help with branch transformation, get in touch with the experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.