The Story:

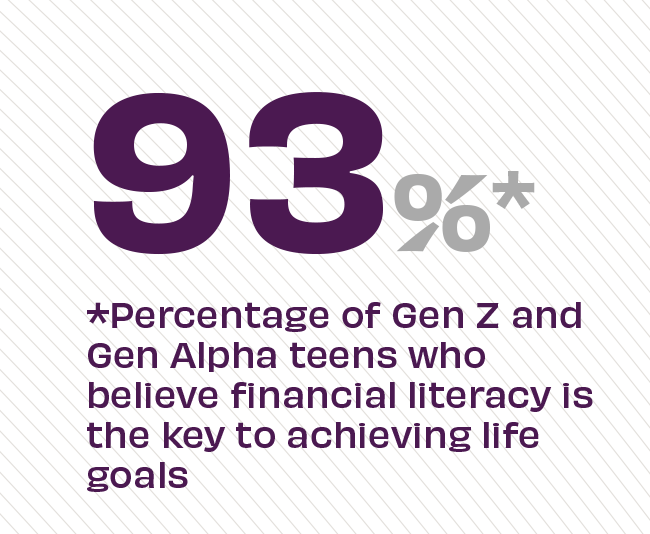

As members of Generation Alpha become teenagers in 2023, they are already thinking about their money. New data on Gen Z and Gen A finds that 67% of teens and their parents rank finances as one of their most talked about issues over the past six months. This makes sense given the fiscal fallout from the pandemic and the rise of online resources like social media and finance apps at their fingertips. But despite these resources, teens still score an average of only 64% on the National Financial Literacy Test.

The Takeaway:

Though 48% of Gen Alpha kids learn about finances from social media, most report they don’t trust all the information they read. Smart banks and credit unions are stepping up to help meet the financial needs of this generation that Forbes says is “A generation unafraid of money: making it, spending it, investing it, and budgeting it too.” In what amounts to a near-perfect scenario for traditional FIs, banks and credit unions have both the expertise and integrity to provide resources that resonate with teens and young adults, along with their Gen X/Millennial parents.

Source: Forbes, “Survey: Gen-Z And Gen Alpha Place High Importance On Financial Literacy, Just Like Their Parents,” March, 2022, and Greenlight, “Celebrate Financial Literacy Month with your Kids and Teens,” April 2021