The Story:

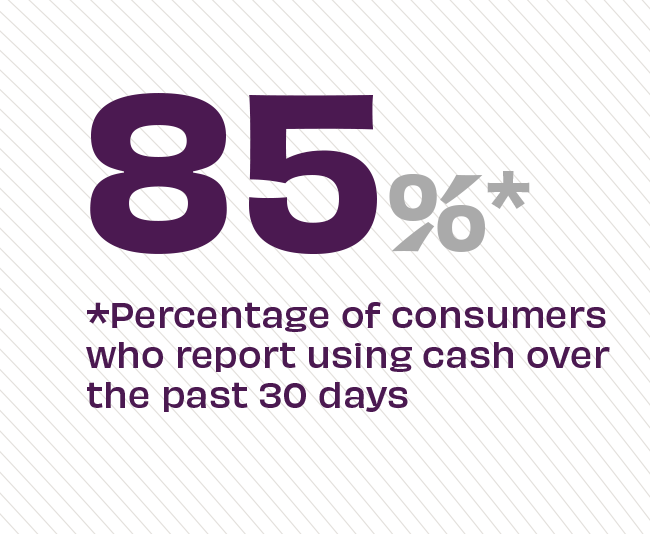

New research finds a notable upsurge in regular cash usage among consumers, rising 3 percentage points from 2020 levels. This trend indicates a resumption of pre-pandemic cash patterns where consumers use cash for making quick purchases, tipping for goods or services, and helping them stick to a budget. Moreover, cash usage may point to inflationary pressures, which have an outsize impact on low-income, service sector and underbanked demographics who tend to rely on cash transactions in their everyday lives. This finding contradicts previous predictions about a post-pandemic upsurge in digital payments.

The Takeaway:

These new findings remind institutions that access to currency is a vital part of banking transactions for most customers. As banks and credit unions assess and update their networks, considerations for cash transactions should remain high on their list of priorities. When it’s time to replace ATMs in their networks, updating them to Interactive Teller Machines (ITMs) will allow consumers to continue access cash, but also do more while using a familiar format. “ITMs can provide the conveniences consumers have come to expect from an ATM, like cash withdrawals, check deposits and balance inquiries,” says Juliet D’Ambrosio, Chief Brand Officer at Adrenaline about the company’s ITM Research. “PLUS advances and access to live video tellers for more complex banking needs, like opening accounts and applying for loans or credit.”

Source: American Banker, “Cash, ATMs Get A Second Wind as Inflation Rises, Pandemic Habits Fade,” March, 2023