Four ways the banking sector has changed during the pandemic and what changes we expect to remain long after the demands of the pandemic decrease

In our last article on COVID as a catalyst, we discussed how advances in healthcare delivery and renewed innovation are impacting the consumer landscape. We then examined what that might mean for the banking industry from the outside-in. But the banking sector itself has experienced and driven considerable change since the pandemic began. On the practical front, we’ve witnessed banking rise up to meet exploding demand for digital access to process transactions – through online banking and mobile apps – along with a focus on repurposing some existing channels for a new role. Notably, the biggest shift we are witnessing is less reactionary (focused on now) and more visionary (for the future).

Our roundup of the four ways banking has changed in the wake of Coronavirus is both a look back and a look ahead to what’s to come.

1. Focus on Safety and Security

Immediately following the initial outbreak of the Coronavirus and even during more recent local and national COVID spikes, the industry has focused its efforts on health protocols to keep staff and customers safe in and around the branch. Whether it’s controlling capacity through mandatory appointments or enforcing behaviors through signage and staff training, remaining safe and secure in the physical branch environment is non-negotiable.

As part of routine post-pandemic operations, most banks expect these measures will remain even after COVID eases. According to American Banker, we are “relying on the safety protocols instituted in the spring to hold the virus at bay — and keep branches open” during the current spike. That’s both because banks are experiencing decreased demand for routine transactions at the branch and financial institutions simply know more about what it takes to continue operating safely.

2. Seamless Channel Integration

The move toward digital channels underway pre-pandemic took on a new urgency during COVID, yet the immediate demand on digital hasn’t translated (so far) into a permanent shift, as more than half of people still want traditional means of processing transactions. Along with repurposing channels like the drive-up window and implementing ITMs that bridge the physical and digital divide, consumer choices in banking are not binary – digital OR physical – but a hybrid bridging of the two.

Transformation is an industry imperative, as Forbes reinforces the key message from the fall panel of bankers gathered to assess the industry six months into the pandemic. According to Trish Mosconi, chief strategy officer and corporate development for Synchrony: “We aren’t going back to February.” The universal drumbeat for banking post-pandemic: Don’t revert back to pre-pandemic practices. Or in other words, embrace the changes brought on by COVID – some of them long overdue – and progress from there.

3. Local Matters More

As consumers shifted their lives to home during the pandemic, community came to mean more to consumers, with a whopping 69% reporting a preference for local brands, according to Kantar in October. For community banks and credit unions, one of their key influences – deep community roots – has achieved new relevance during the pandemic. By leveraging physical branch locations, banking can lean into local ways to demonstrate community commitment.

With an expectation that consumers will switch financial institutions in the coming year and 80% plan on returning to the branch, community institutions have a rich opportunity to deepen relationships at the local level through their branch networks. The local branch is not only a beacon for the bank’s brand, but a more personal channel of experience, where consumers are more likely to turn when they need consultation and advice. Built on trust, the local branch channel – with a mix of formats – is perfectly positioned to demonstrate the value of banking with a local institution.

4. Movement toward Meaning

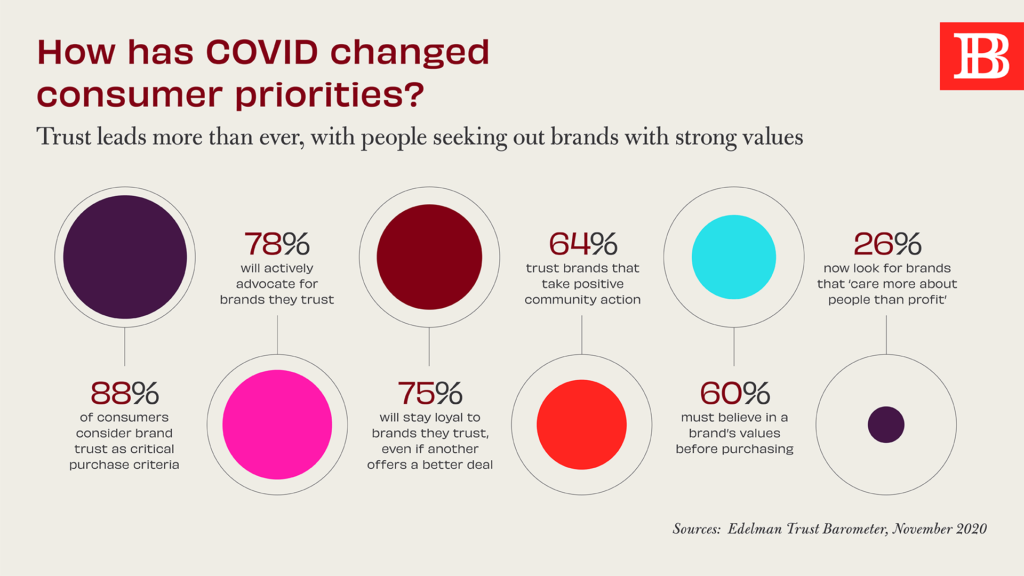

As consumers shift their preference locally, they also simultaneously want brands to mean more, favoring brands that are purpose-driven and use their influence for good. In the immediate aftermath of COVID, people today are more interested in brands that put people over profits, demonstrating their commitment to their customers and communities, by leading with empathy and helping people navigate these tough times in a meaningful way.

Trust leads with consumers now more than ever, and that’s something that will endure long after the pandemic subsides. As Edelman’s Action Mandate for Brands During Crisis finds: “[S]ixty percent of consumers buy brands they trust. In exchange, consumers expect brands to take a stand on societal issues while solving personal challenges.” That means consumers care, and they expect brands to care, as well. With a renewed focus on the personal, brands must develop a strategy that defines their clear purpose and values, and then act with courage and commitment now and in the days to come.

For more insights on banking’s response to COVID, be sure to stay tuned to Believe in Banking as it tracks the big trends that are impacting the financial industry and informing the banking experience. To begin developing experience-based strategies for customers and members in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com. For more information on bank branch operations in the post-COVID landscape, download the Roadmap to Reopening.