The Story:

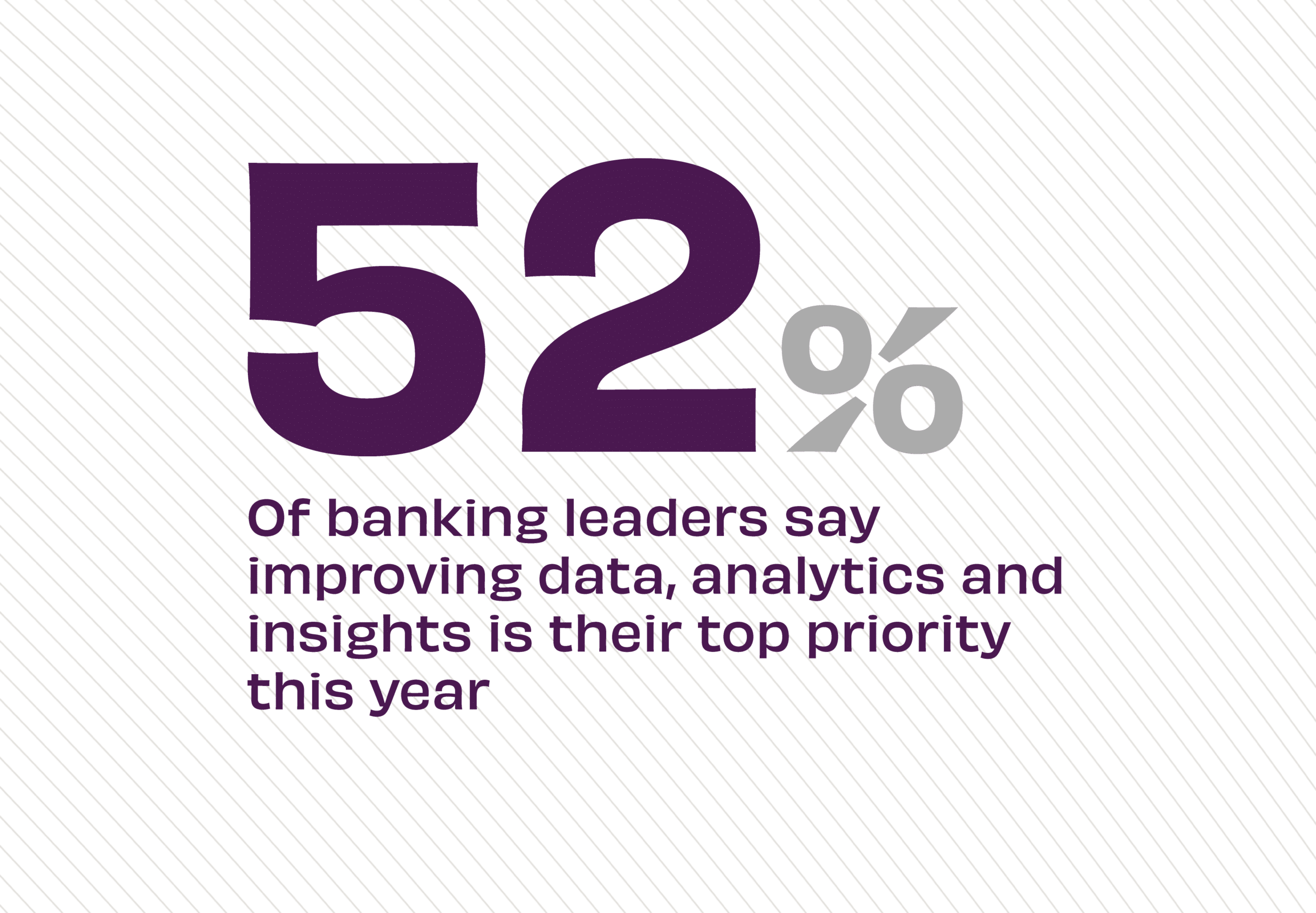

Data from the Financial Brand on current retail banking trends and institutional priorities finds that banking leaders are leaning into data to influence how their bank or credit union modernizes to meet consumer needs. More than half of all banking leaders say improvements to data, analytics and insights is their top priority this year, with 27% ranking the effort as their second most important institutional priority. To meet consumer demand for personalized banking solutions, financial institutions must focus on smart data strategies.

The Takeaway:

Institutions looking to create deeper banking relationships should use a data-infused framework to inform customer journeys, since “personalized emotional connections now determine consumer lifetime value more than rates or fees,” according to the Financial Brand. Consumer need for tailored solutions combined with their complex financial lifestyles means banks and credit unions must find ways to deliver “extreme customization at scale” to earn the coveted consumer primary institution of choice, now and in the future.

Source: Financial Brand, “Retail Banking Trends and Priorities Report,” January, 2024