Positive consumer outlook paired with a stabilizing banking environment brings economic optimism while inflationary pressures persist

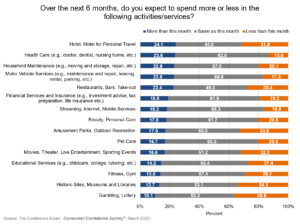

Even with a challenging environment following notable regional bank failures, optimism about the economy is on the rise, according to two surveys spotlighted by US News. “Consumers appear to have shrugged off the recent banking crisis,” finds a consumer sentiment survey in March from the University of Michigan. Even more, short-term outlook is on the way up. “Consumer confidence surprisingly rose in March as consumers turned more optimistic about the future, while still remaining concerned about the economy,” according to the Conference Board. “The Expectations Index, measuring the short-term outlook for the economy, edged up [on a scale] to 73 from 70.4” from the prior month with spending expectations in key areas remaining largely unchanged.

Institutional Outlook

While smaller and midsized institutions experienced some deposit outflows, the banking sector in the U.S. is “stabilizing,” according to Treasury Secretary Janet Yellen, as reported in Bloomberg. “The outflows from smaller and medium-sized banks are diminishing and matters are stabilizing, but it’s a situation we’re watching very closely,” Yellen told reporters in early April. “I don’t think there’s a fundamental problem with the banking system, but we’re not willing to allow contagious runs to develop.” While the U.S. banking sector took a blow from the failures, the ripples internationally seemed to be largely contained. The Bank of Canada said it’s “ready to step in with support if the banking system came under severe strain,” something looking increasingly unlikely.

The sentiment of steadiness was echoed by industry insiders, as they look at current conditions across the banking landscape. “A sense of calm seems to be returning to the system following a few unfortunate weeks of turmoil,” says Piper Sandler analyst Scott Siefers in reporting from American Banker. This good news of stabilization comes as institutions losing deposits during the crisis return to a position to recoup them. “Small and midsized banks won back nearly $6 billion of deposits during the week that ended March 22,” according to American Banker. “Marking a modest but important gain” that curtailed losses earlier in the month.

For their part, economists can’t seem to reach a consensus on future forecasting. While some are warning of runaway inflation, economist Paul Krugman points out that the history of the U.S. economy tells another tale. “When depositors pull their money out of banks, the effect is disinflationary, even deflationary,” Krugman says in the New York Times. It’s true that recessionary pressures endure, some fundamentals like consumer spending, the labor market and employment have stayed strong. “The U.S. is grappling with high inflation and rising interest rates meant to get prices back under control,” according to a Marketwatch analysis. “But so far the economy is still in expansion mode.”

For the latest news impacting the banking industry, stay tuned to Believe in Banking’s continuing coverage of top trends and topics. For the industry’s best practices and perspectives, visit Adrenaline’s Insights. And if you’re a banking leader looking for strategies customized for your institution, contact our banking and credit union experts via email at info@adrenalinex.com.