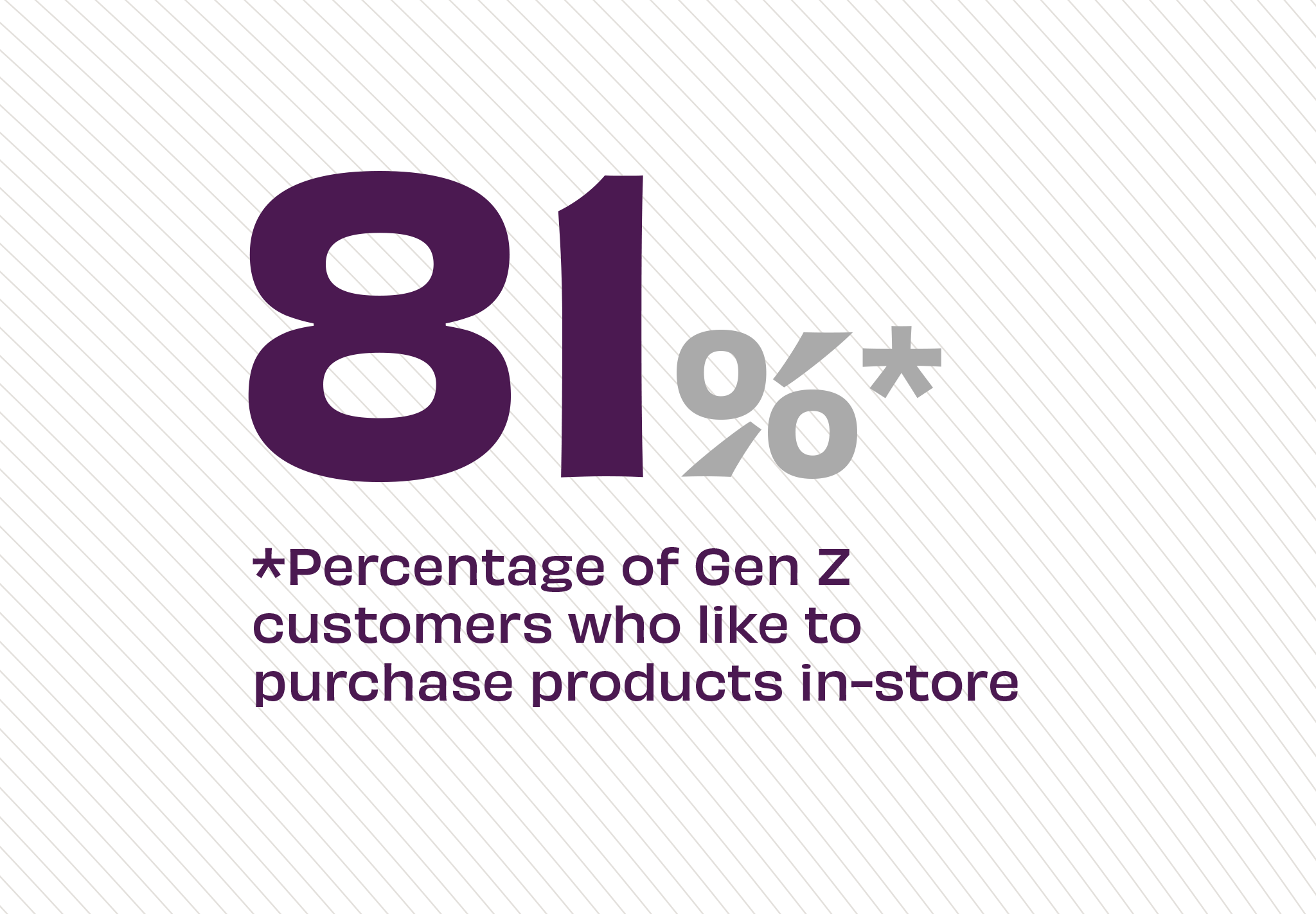

The Story: A vast majority of Gen Z customers still want the experience of in-person shopping, with 74% emphasizing the value of “curated” store experiences, according to new data on generational shopping habits. For many Gen Z consumers, in-person experiences provide an opportunity to “unplug” from the ever-present ubiquity of social media – although many may also pursue in-person experiences so they can post about them on social media. Moreover, 71% of consumers – who have been conditioned by e-commerce expect retailers to track their preferences and purchasing behaviors – express feeling frustrated when a shopping experience is not personalized.

The Takeaway: Though it is clear that customers prefer personal interactions over personalization via AI, successful brands must be able to deliver BOTH in order to remain relevant in the current consumer landscape. Since consumers have come to expect retailers to provide personalized experiences by recommending products and services using purchase behavior data, they will expect FIs to do the same. Moreover, since 25-50% of all banking products come from institutions other than the consumer’s primary bank, FIs have an opportunity to offer more products to the customers they already know by successfully anticipating their needs.

Source: Kearney Consumer Institute, “How Gen Z’s Concern with Emotional Health Fuels Retail Growth and Failure,” October, 2021