First things first: considerations for building a smart brand strategy following mergers and acquisitions

One of the most high-profile financial brand marriages in recent memory, 2019’s SunTrust and BB&T merger gave us a very public view into the challenges of integrating two beloved super community banking brands together following M&A. From their new Truist name to an updated brand identity, people had strong reactions to this financial brand union. Gina Bleedorn, CXO at Adrenaline, described the importance of strategy when interviewed about the Truist brand change in American Banker, saying, “I think [the name] will hit them initially not well, and then it will grow on people. SunTrust and BB&T will need to put the right brand story behind it, and they can make that happen in the right way.”

Fast-forward to today. While it’s certainly true that COVID has shifted banking’s focus to their daily operations, it’s still critical for financial services to continue scaling and strategizing – rising above the fray to consider long-term growth opportunities. In fact, with all indicators pointing to an active upcoming M&A season, it’s essential for banks and credit unions to look beyond our COVID moment for ways to reshape the competitive landscape through targeted growth. As it was before the pandemic, mergers and acquisitions present a distinct opportunity for financial services. But beyond the union, developing a strategy for aligning brands post-merger will be what determines if the marriage is a boon or a bust.

Smart Brand Strategy

The agreement has been reached across all parties—the FTC and legal have signed off and two brands are coming together. Now what? Mergers and acquisitions come in all different sizes and scopes. It’s not always as simple as the one brand – usually the acquiring brand – “overtaking” the other. According to the Financial Brand, “[B]rand is the most powerful – but often the most overlooked – tool for solving many of the common problems in a merger. Rather than viewing branding in a merger as little more than a name-and-logo exercise, the brand should serve as a compass to synchronize the new company’s internal culture and represent its values to the outside world.”

It’s that internal alignment and external expression of the brand that employees and consumers come to know, internalize, and love (or not). A customer-centric approach is key – looking at the brand merger through the eyes of the people who matter most to its success. Beginning the process with a strong brand strategy is critical, analyzing each brand’s unique value proposition and relationship with the customers they serve. Beyond integrating values and cultures, the new brand must focus on engagement and creating a unified experience across two potentially very different brands – to truly deliver the growth opportunities that drove the merger or acquisition in the first place. Brand sits at the center of decision-making after inking the deal, with a careful assessment and analysis to inform the right brand approach.

Post-merger evaluation includes assessing factors like:

- Brand equity (and liabilities) – What strengths and level of awareness does each brand bring, and what’s essential to maintain moving forward?

- Competitive landscape – How scaling helps better compete, geographically and demographically

- Audiences – Are they materially different or similar in behaviors and values?

- Legacy market penetration – How is each brand positioned, and what opportunities exist to build on these strengths or optimize weaknesses?

Structured for Success

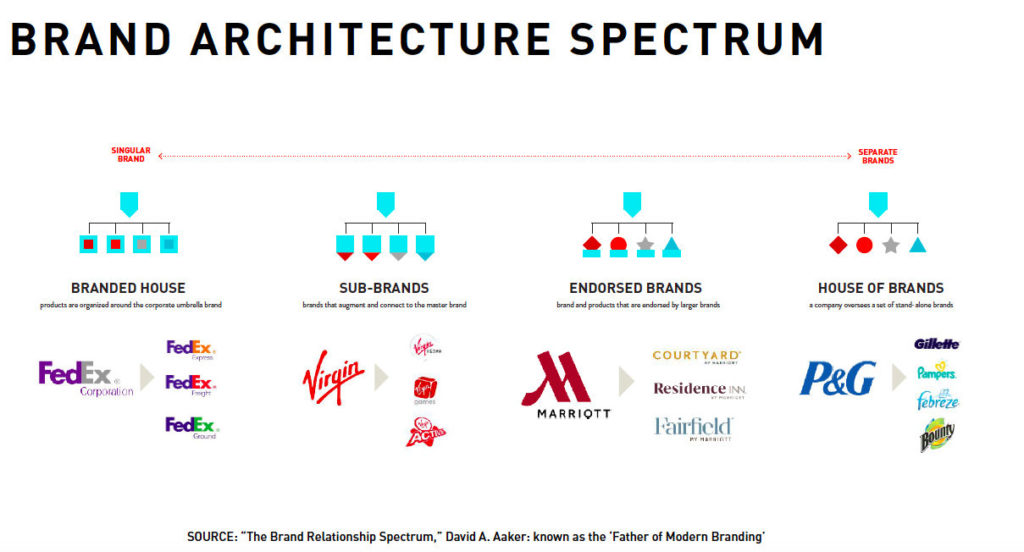

Following a merger or acquisition, brand architecture is an essential first decision. Will these two brands co-exist in any way? Are future acquisitions likely? Is the equity of the brands being acquired strong enough to maintain as an endorsed brand model or does the acquired brand need to be converted into a single brand? With all of the coordination it takes to pull off a merger, the relationship between merged brands may be the furthest thing from anyone’s mind. Yet, it’s those brands that take the time to strategically and holistically address their structure that achieve the greatest success.

Three critical considerations to inform decision-making around brand architecture include:

- Do you have different audiences (geographically AND demographically)?

- Do you have different brand promises (with a unique product or service for each brand)?

- Do you have different geographic areas (non-contiguous and disparate)?

The singular approach to brand architecture, often called a branded house, organizes, or converges all brand activity under one parent brand umbrella. In the case of one larger brand acquiring the other with some geographic overlap, the acquiring brand typically takes this leadership position. It’s the most common structure in financial services following M&A, as one unified brand is less likely to cause consumer confusion. In this case, the brand architecture decisions become a matter of conversion – shifting all the legacy elements across every touchpoint from one brand to the other.

Unifying under one brand umbrella there are two main approaches:

- A phased approach, which rolls out elements of the “new” brand over time, beginning typically with easier-to-convert digital touchpoints. Next brand communications are converted, with in-branch messaging following close behind. Finally, signage and in-branch conversion to align all brand assets.

- An overnight approach, in which all elements launch to market at once. This takes much more upfront coordination with key internal stakeholders in alignment with leaders. Robust planning over months addresses every contingency from launch to logistics, as the brand has only one chance to get this right. In this case, temporary exterior signage buys time for the full conversion.

In our next feature, we will look at some best practice examples of financial brand conversions following M&A, including unifying under an acquirers parent brand; strategically leveraging the high-equity elements of two legacy brands into a new whole, and a merger of equals coming together to create an entirely new brand. To begin developing M&A strategies in the face of COVID, contact Adrenaline’s experts at info@adrenalinex.com or (678) 412-6903. For more information on bank branch reopening in the post-COVID landscape, download the Roadmap to Reopening. If you need support for staffing, see the Frontline Staff Engagement Training series.