The Story:

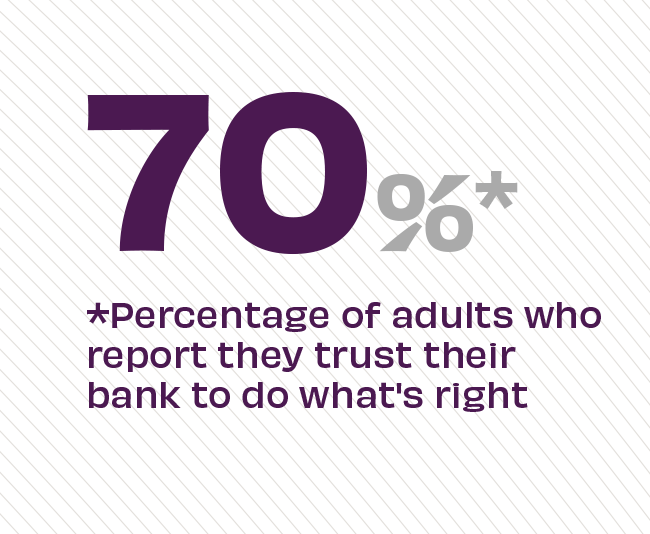

New survey data from Morning Consult finds that Americans’ level of trust in banks has remained resolute even in the wake of key institutional failures over the last two weeks. After the collapse of Silicon Valley and Signature banks, the industry was on alert for the prospect of fear spreading, but data finds that confidence in banking is about as high as it was this time last year. Trust is highest among customers of regional and national banks (at 81% and 78%, respectively), next among customers of community banks and credit unions (at 71% and 67%, respectively) and lowest but still respectable among customers of digital banks (at 57%).

The Takeaway:

Moments like this provide an opportunity for banks to communicate with trust and transparency and share insights into their institutional approach to balance and diversify their holdings. VeraBank did exactly that when they sent out an email and posted a powerful letter from their CEO, which notably included the CEO’s personal phone number, so he could answer any questions customers had about the safety of their money. Of the 100 or so customers he heard from, according to Adrenaline, the great majority called or texted to simply thank him for proactively communicating. “I thought it was really important that we get our story out,” Tidwell said in his interview on NPR’s Marketplace, to differentiate themselves from the failed banks and spotlight their core values.

Source: Morning Consult, “Consumer Trust in Banks Remains High Despite Recent Bank Collapses,” March, 2023