New supplemental report to the Edelman Trust Barometer finds banking trust up 12 points over the last decade

A new supplemental report to the Edelman Trust Barometer finds that banking has been consistently building trust every year since the 2008 financial crisis. Edelman Trust Institute’s Insights for the Financial Services Sector shows “banking scored a 65 – up three points since last year and 12 points from more than a decade ago,” according to American Banker. “It’s encouraging to see banks in the trusted category, and really continuing to build trust as we move forward,” says Sean Neary, Edelman’s co-head of U.S. financial services, in American Banker. “Amid all the economic uncertainty of this past year, the sector really remains strong. It has served as a stabilizing force, something that we can count on.”

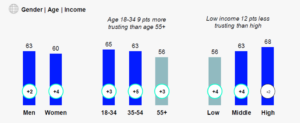

Digging into the report’s details about the sector’s performance, trust in financial services has grown twice as fast over the last decade among those with higher earnings than those with lower incomes. For banks specifically, trust is solid across most demographics. Respondents in the 18-54 age cohort trust banking generally, but those 55+ are more neutral. While men report a greater level of trust in banks than women, banking made larger gains with female consumers, up four points since 2023. Across financial services, banks are the most trusted subsector among their peers, beating out insurance, financial advisory and financial technology, among others. Cryptocurrency is the least reliable with only 38% trusting the digital asset.

For banking, consumer trust has been on sound footing, even through the regional banking crisis that rocked the industry in 2023. Just a month after Silicon Valley Bank, Silvergate Bank and Signature Bank failed, Morning Consult found that when asked whether they trusted banks to “do what is right,” 70% of consumers said they do. “Trust in the industry of financial services is really consistent across the board, says Jaime Toplin, financial services analyst at Morning Consult, in a Fortune/Yahoo! Finance article on trust in traditional banks. “I think that that’s because these relationships are very long-lasting with people.”

While regional banks may have taken a hit in consumer confidence, their challenges did not spread across the banking industry as a whole. In the aftermath of the crisis, American Banker found that essential institutions remain a “safe harbor for deposits” with the majority of banks having liquidity and diversity to more than withstand any withdrawals. What remains clear is that financial institutions have spent decades building their banks on a foundation of trust. “These community institutions have their local neighborhoods at their core,” according to Adrenaline’s Sean Keathley in 2023 on the industry response. “They want to do everything they can to be sure people’s money is safe and their communities thrive. That’s what drives them.”

If you’re a financial services leader wanting to deliver better banking experiences, get in touch with the experts at Adrenaline. And don’t forget to subscribe to Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.