As Gen Alpha grows to 2 billion members, banks and credit unions must begin engagement early to convert this next generation into customers as they grow up

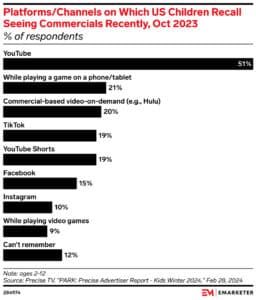

With an impressively large population that’s still growing, Generation Alpha will reach 2 billion people by 2025. “Gen Alpha is on track to become the largest generation,” according to “What U.S. Banks Need to Know About Gen Alpha” from Research and Markets. “Banks must start building relationships with children today to convert them into customers as they grow up.” As the oldest members reach their teenage years, Generation Alpha already impacts up to $5.5 trillion in spending, and their media habits have an influence all of American life, most especially their consumption of video content.

In addition to meeting them where they are (YouTube), another key to making inroads with this generation is their Millennial parents. “Financial institutions can begin engagement early to build relationships with potential future customers,” according to the Global Banking and Finance Review. Their Gen Y parents help shape the principles and preferences of the next generation. “They prioritize saving and seek brands that align with their social and political beliefs. Millennial parents also focus on building generational wealth and teaching their children about financial literacy from a young age.”

One neobank brand focused on kids and money is doing just that. Greenlight is expanding into the B2B space by partnering with more than half a dozen firms. “The new partnership program, Greenlight for Banks, allows banks and credit unions to offer the fintech’s suite of banking and education products to their customers through a co-branded landing page and app,” according to Banking Dive. “[W]e found that many [financial institutions] don’t have the expertise or resources to create a compelling digital banking experience for the next generation,” says Matt Wolf, Greenlight’s SVP of Business Development. “We’ve designed something that really helps financial institutions seamlessly integrate family banking into their own ecosystems.”

If you’re a financial services leader wanting to deliver better banking experiences to the next generation, get in touch with the experts at Adrenaline. Follow Believe in Banking to stay up to date with the latest news impacting the banking and credit union industries.