The Story:

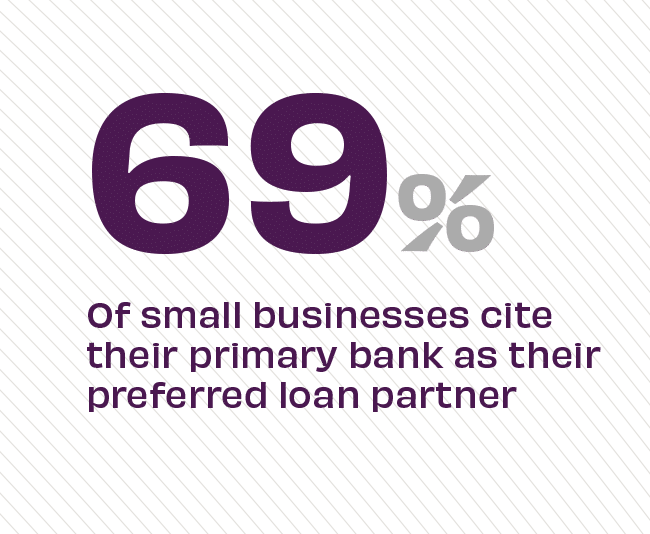

Although the pandemic brought many small businesses to community financial institutions through the PPP program, those same banks and credit unions don’t have a proportionate amount of small business lending accounts today. Despite business owners’ preference to work with their local bank, fintechs like Kabbage, PayPal and Blue Vine are snagging up a growing amount of market share. With nearly two-thirds of the 32.5 million small businesses nationwide planning to borrow an average of $2M over the next two years and experts predicting a dip in real estate lending, community-based financial institutions should focus their marketing efforts on opportunities with the highest potential, which includes commercial and small business lending.

The Takeaway:

Incumbent banks that already have consumer trust, convenient branch locations and systems capable of getting money to borrowers quickly should make sure they are reaching out to small businesses in their community. Though FIs offer the products and customer service that small business owners want, fintechs have a fighting chance because they invest more heavily in digital marketing. By using search engine optimization, social media marketing and strategic digital advertising, community banks and credit unions can find customers on the channels they visit the most.

Source: Cornerstone Advisors, “Small Business, Big Ambitions,” November, 2022